The Ultimate Guide to Liquidity Providing in Crypto Markets

In this post, we’re sharing every relevant bit of information about liquidity providing in crypto markets. This guide is perfect if you’re a beginner and want to be familiar with the topic, but also more experienced DeFi enthusiasts will find some useful info about liquidity providing.

Yield is hard to find in traditional finance these days, which has created much interest in new kinds of yield-bearing investments. Thanks to the Ethereum blockchain and the automated market-making model employed by Uniswap, investors now have a convenient option to earn a yield on their crypto assets.

In this guide, we’re covering:

- The Basics of Using Ethereum & DeFi

- What is a Liquidity Pool?

- Advantages and Disadvantages of Liquidity Providing

- What to do Before Providing Liquidity

- Learning the Protocols

- Learning the Risks of liquidity providing

- Finding the Right Pools

- Tracking your Investments and liquidity providing activities

- Taxes

Get familiar with Ethereum and the DEX concept

What is Ethereum?

Ethereum is the world’s programmable blockchain. Ethereum was inspired by the groundbreaking innovations of Bitcoin and built upon those foundations for increased programmability that enable digital money, global payments, and applications. It is a community-built system behind the cryptocurrency Ether (ETH) and thousands of decentralized applications. No government or company has control over Ethereum. This decentralization makes it nearly impossible for anyone to stop you from receiving payments or using services on Ethereum.

What is DeFi?

DeFi is a subset of the Ethereum ecosystem that focuses on financial applications. Thanks to smart contracts, DeFi applications can automate many of the activities that are time-consuming and labor intensive in the current system. The growth of these applications is disrupting traditional finance and creating more efficient ways to lend, save and borrow.

What is a DEX?

DEX stands for decentralized exchange. The DEX concept has been around for a while, taking various forms. In the early days of Ethereum, the largest DEX was EtherDelta, which employed a model similar to a traditional order book exchange. EtherDelta ran into legal trouble and suffered from low volume. In 2019, on the back of a Vitalik blog post, Hayden Adams launched Uniswap. Uniswap used an innovation called automated market-making, which enabled permissionless liquidity and trading. In the last couple of years, Uniswap has grown tremendously. In the fall of 2020, they surpassed Coinbase in trading volume, indicating a bright future for the DEX space.

What is the difference between Uniswap and Coinbase?

Coinbase is a centralized exchange, and Uniswap is a decentralized exchange. Uniswap can not be easily turned off or made to stop operating. Once the code has been deployed to the Ethereum blockchain, it can’t be stopped. A centralized exchange like Coinbase is accountable to state actors and, in extreme circumstances, can seize funds or cease trading.

What is gas?

Gas is the fuel that runs the Ethereum network. A gas fee works very similar to how a transaction fee works on a centralized exchange, it is the cost of using the platform. Gas is displayed in units called Gwei, which is a small fraction of a single ETH. During times of peak network load, the gas price can reach levels that make it prohibitively expensive to move smaller amounts of tokens. If you want more information about gas costs in DeFi, APY.Vision did some research on the subject and published an infographic that will give an idea what various DeFi actions cost in gas.

What is a wallet?

Wallets are applications that let you interact with various blockchains. It has many similar features to banking services. Your wallet lets you read your balance, send transactions, and connect to applications. There are typically two types of wallets, custodial and non-custodial. A custodial wallet has control of your funds and is usually run by a centralized service. A non-custodial wallet has no ability to control your funds and is under the user’s control. There are advantages and drawback to each approach. A custodial service has some ability to recover misplaced funds or help you regain access to your account. When you are using a non-custodial service there is a chance you could lose your private keys and lose access to the wallet.

What is a liquidity pool?

A liquidity pool is a smart contract that allows a user to deposit assets into a pool managed by the smart contract. The pool is used for liquidity to power the swapping ability of a DEX. Investors are encouraged to deposit into liquidity pools because they earn revenue from the swaps that happen on the DEX platform. There are many ways to invest in liquidity pools.

Advantages of liquidity providing

Earning fees

A pool with a popular token pair can have high volume, which leads to higher fees. On Uniswap, each trade is charged a 0.3% protocol fee that is split evenly among the liquidity providers in the pool according to what share of the pool they own. High volume means more trading, which in turn generates more revenue for the pool. Your share of those fees is dictated by what percentage of the pool you own.

Earning tokens from farming rewards

A new trend in Defi that has allowed many projects to distribute their token is the concept of liquidity mining. In exchange for locking some of your token assets on a given platform, the platform can reward you for your participation in the form of farming rewards. This practice was started by Synthetix and Compound and was quickly adopted by the industry.

The rewards for providing your liquidity to a platform can be very generous with eye-popping APY figures, but it is important to remember these lucrative farms typically are only for a set period of time, usually a few weeks. It is important to keep close track of your liquidity pool gains and your net market gains while you are farming. It is recommended to compare this to how much you are receiving in farming rewards to make sure it is profitable.

Airdrops (Token Drops)

Every once in a while, a project will decide to retroactively reward users who have staked in certain pools with something called an airdrop. They are generally done to reward users for providing their liquidity during the early phases of a project’s growth cycle. As an example, when Uniswap launched their UNI token, 49 million UNI were airdropped to historical liquidity providers as way to make sure that rewards were weighted towards LPs that provided liquidity when total liquidity was low.

Disadvantages of liquidity providing

Liquidity providing comes with a unique set of risks that are important to be aware of.

Impermanent loss

The ideal scenario for liquidity pool holders is “sideways” trading with no large swings to the downside or the upside. Given that most pools’ base asset is ETH, you have to consider ETH price movement into your risk assessment. The pairs with the lowest impermanent loss are the tokens with the highest correlation to ETH’s price.

Rug pulls

A prominent example of a recent rug pull was the scandal surrounding the Compounder project. What made it even more scandalous than usual was that a well-known security firm had audited the project, and the vulnerability was disclosed in the audit report. That did not seem to deter some investors as over $10 million was deposited into the pool before Compounder made malicious changes to the smart contracts to allow them to withdraw funds, stealing millions of dollars in the process.

How do you prevent being rug pulled? The easiest way to avoid sketchy projects that might engage in this activity is to use ranking sites that list projects that have been examined by professionals. DeFi Pulse and other projects help in this respect. The age and reputation of a project go a long way towards establishing credibility. Although some good anonymous developers in the crypto space exist, an anonymous team can raise suspicion as it makes it easier for a project to attempt a rug pull.

What to do before liquidity providing

Get familiar with the protocol

Figure out where you want to provide liquidity and learn the rules of the platform. One important thing to note is that many of the places you will find to provide liquidity are based on the Uniswap code, which is open-source, meaning anyone can copy the code and redeploy it (called a fork).

- Uniswap -50/50 AMM pools, no UNI farming at the moment

- Sushiswap – Forked Uniswap, 50/50 AMM pools, SUSHI farming available

- Balancer – Multi-Asset Pools with variable weights (80/20, 95/5), fees set by pool creator and options for private pools

- Quickswap – Forked Uniswap on the Polygon network, low gas fees, need to use the MATIC bridge to deposit funds

- PancakeSwap – Forked Uniswap on the Binance Smart Chain

Find the right pool

What is the level of risk you want

Liquidity pools inherit some of the risks of the tokens that make up the pool. A token with volatile price action is going to come with a lot more risk of impermanent loss. A token pair with very little price volatility will have much less risk of impermanent loss. When you are looking for pools to invest in, there are some criteria you can use to help narrow your options.

Stablecoin pools for safety

The stability portion of the stablecoin name is what protects it from impermanent loss. A liquidity pool comprised of two stablecoins is an excellent low-risk source of yield compared to pools with non-stablecoin tokens in the pool. For an investor looking to get started in liquidity providing, stablecoin pools are a safe place to get started.

Make your move and then track it

There are many free tools available to help you keep track of your DeFi comings and goings. Most users find these tools very valuable as it can be easy to lose track of what you have done on the blockchain.

Etherscan

Etherscan is in a class of tools called block explorers. They are an essential tool to verify events on the Ethereum blockchain. Most Dapps have an option to view your transaction on Etherscan so you can be made aware when a transaction has gone through. If you have a problem with a dApp and want to make sure that your transaction went through, Etherscan is usually the first place you would check to learn what happened. If the transaction failed or had some other issue, Etherscan will list what happened.

Dextools

Dextools is a real-time dashboard for on-chain data analysis that allows you to track tokens being traded on Uniswap and Sushiswap. It provides a very familiar charting interface for decentralized protocols and assets.

Calculate your liquidity pool loss or gain

APY.Vision

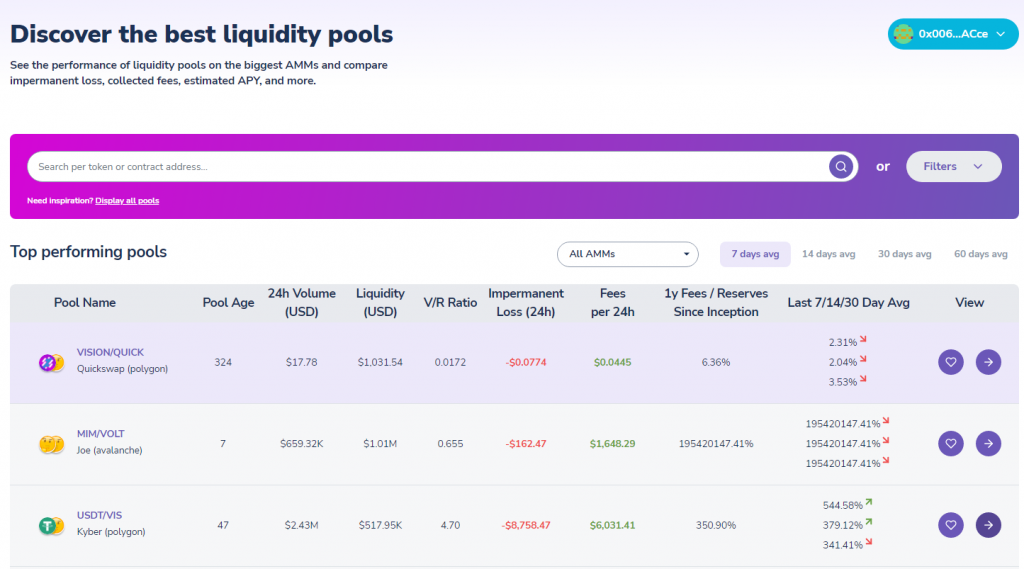

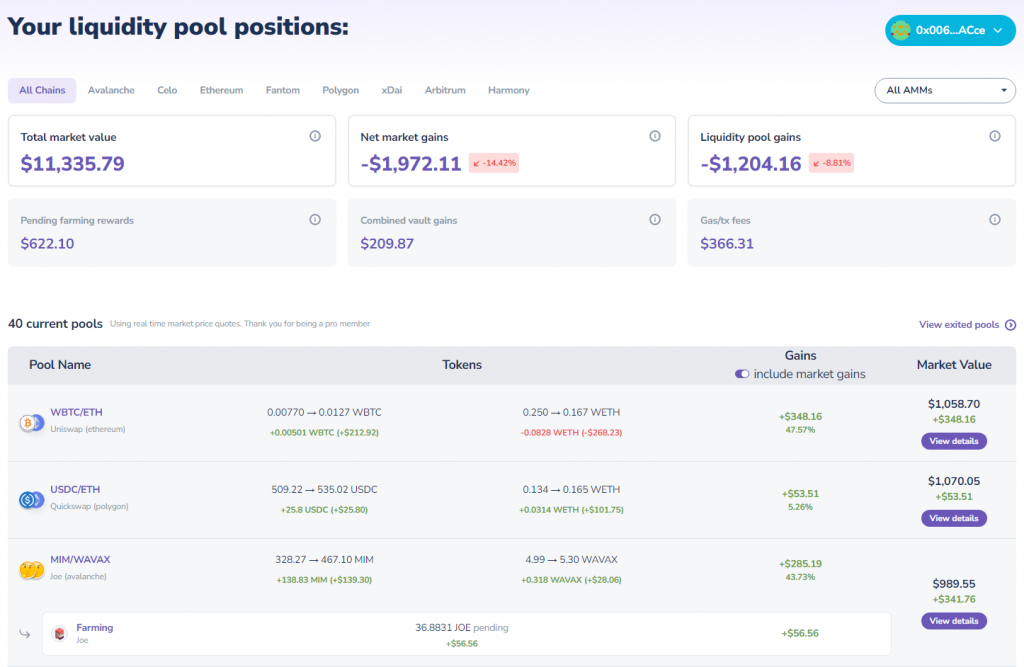

APY.Vision is an all-in-one liquidity pool analytics and yield farming rewards tracking tool that lets you manage your liquidity pools and track yield farming rewards with one easy dashboard. Because liquidity pools are complex and have many variables that dictate profit or loss, it is essential to have tools to understand what is happening with your various positions. APY.Vision also will assist you in searching for new pools to invest in and will also track your profit and loss.

Don’t forget taxes!

Jurisdiction

Taxes will work differently depending on your country of residence. Some countries have very relaxed crypto taxation, while others tax every transaction. Getting familiar with your local tax laws is highly advised.

TokenTax

There are services out there that can do a lot of the heavy lifting in terms of calculating tax payments. TokenTax is the leading crypto tax platform and cryptocurrency tax accounting company and will prepare your crypto taxes and has various pricing packages.

Check out APY.Vision!

APY.Vision is an advanced analytics tool for liquidity pool providers and yield farmers. If you’re using any DEXs, AMMs, or liquidity pools, this is the tool you will need to easily track the ROI of your liquidity provider and yield farming activities. Try it now!

APY.Vision does not give investment advice and always insists that you do your own research. Read our full Legal Disclaimer.