How to Choose a Liquidity Pool

This post will talk about how to choose a liquidity pool and the various factors you should consider when making a decision.

Providing liquidity to a liquidity pool (usually in an Automated Marketing Protocol, or AMM) is a new concept that was not commonly known just 12 months ago. With the rising popularity of Uniswap and other AMMs, there is also a rising demand for liquidity providers to provide liquidity.

The Benefits of Providing Liquidity

The lure of providing liquidity is pretty attractive — you get to pocket a portion of the transaction fees for every swap that happens. This fee can range from 0.01% to 10% on each transaction, so it’s no wonder why a new profession has come out of this innovative technology in 2020.

The Risks to Providing Liquidity

By now you might be tempted to quit your full-time job and jump into providing liquidity full time. After all, you can now just sit back and collect fees all day, right?

Here at APY.vision, our goal is to provide the best analytics for Liquidity Providers (LPs) and give them insights to be successful at providing liquidity and if you think there are no risks to being an LP, think again!

The (Dreaded) Impermanent Loss AKA Divergent Loss

The biggest risk to an LP is the idea that there is Impermanent Loss (IL) when providing liquidity. The risk is that the allocation of assets you put into the pool initially has shifted. Because the tokens you provide to a liquidity pool has a ratio between the assets (ie. price) when you first started, any movement of that ratio will result in some IL, which is always a negative value. The higher the price divergence of the token prices in the pool, the more IL will be suffered.

Given this, a lot of people ask us in our Discord community server, “How do I determine the best pool to be in?” so we decided to answer this question in this blog post (in case you want to join us, please click here).

How to Choose a Profitable Liquidity Pool

The way to choose a liquidity pools involves four main things we want to evaluate.

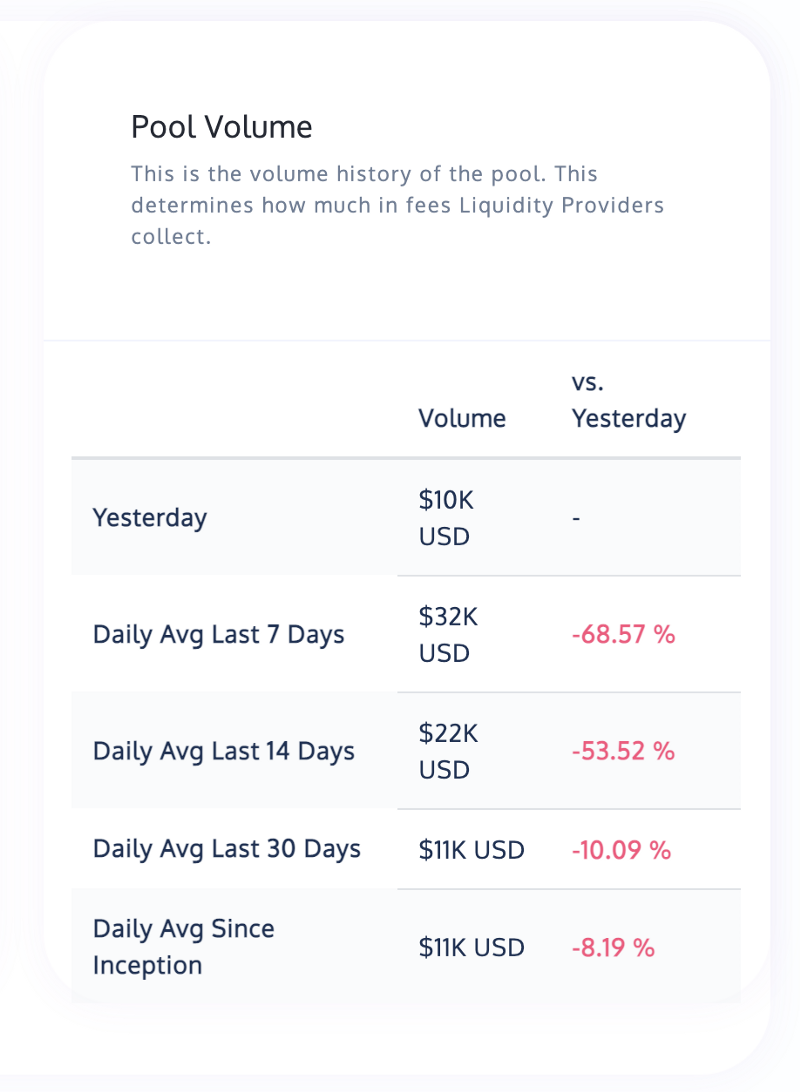

1. Volume

The daily volume of the pool is important to LPs because we make money only when there are swaps happening! Currently, for Uniswap we make 0.3% off each transaction, so the higher the volume = more profits.

Here at APY.vision, we show you what the volume history looks like on our Advanced Pool History page.

2. Reserves (aka Pool Liquidity)

We also want to know what the size of the liquidity pool is to ensure that pool is not subject to wild price swings. The lower the reserves, the more it is susceptible to price slippage, which means the price ratio will move (not a good thing for LPs).

Also, we want to ensure the pool is not made up of only a few whales since they can affect the price ratios should they exit the pool.

3. Volume / Reserves

We want to know the ratio of this metric over time, as it will give us a sense of the APY rate that we should expect going forward. We want this number to be increasing (or stay constant) over time, and not decreasing (meaning you are earning fewer in fees over time).

4. Price Divergence of The Tokens

When the price of the tokens in the pool move opposite to each other, you will suffer from Impermanent Loss. This is known as price divergence which leads to impermanent loss. The mathematical formula behind AMMs such as Uniswap will dictate that the will be losses incurred when the price ratios move from the original ratio at the time you put in liquidity. The more the price divergence, the high impact of impermanent loss will be felt (and thus leading to more losses when you exit liquidity).

In the above example with the DAI/ETH pool, if you provided liquidity when the pool started, your APY from providing liquidity would have been -10.61% since there was a large price divergence of the tokens since then. It would have been better off holding DAI/ETH than to provide liquidity.

Again, you can use APY.vision to see what the fees and impermanent losses look like over time by using our Advanced Pool Stats page.

We provide a handy chart to show you what your assets would be worth over a while in the various scenarios. In the example above, the best thing to do was to buy and hold 100% ETH since the start of the pool (and not provide liquidity) as that would have made you the most in gains.

How to Chose a liquidity pool – Conclusion

So it might seem that providing liquidity might be an easy way to make money off fees, there is a good chance that if you don’t know what you’re doing, you might end up losing money. At APY.vision, our mission is to power this breed of investors with a set of tools to analyze their gains to ensure that they are successful as liquidity providers.

View our tools at: https://apy.vision and if you have any questions, please join our Discord: https://discord.gg/ePfGAYbqUq

Check out APY.Vision!

APY.Vision is an advanced analytics tool for liquidity pool providers and yield farmers. If you’re using any DEXs, AMMs, or liquidity pools this is the tool you will need to easily track the ROI of your liquidity provider and yield farming activities. Try it now!

APY.Vision does not give investment advice and always insists that you do your own research. Read our full Legal Disclaimer.