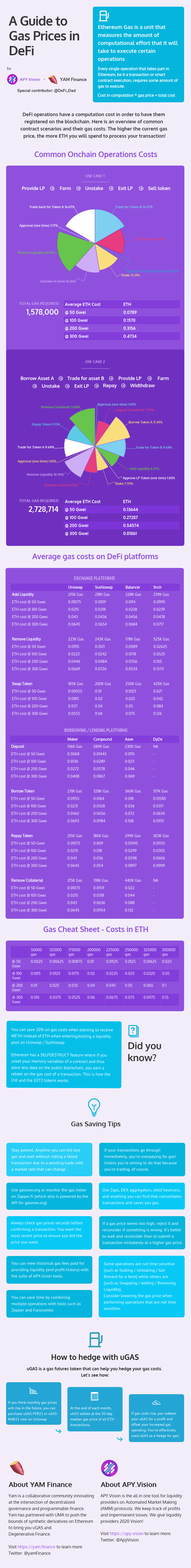

A Guide to Gas Prices in DeFi

How much gas is this transaction going to cost?

It seems like every time ETH has a big price move; gas prices get out of control. We felt like some help was needed to make sense of how much operations are costing on the blockchain. High gas prices can make transactions get very expensive if you attempt them during times of peak network congestion. We created this handy infographic to give DeFi users some help in planning their gas expenses.

Tips to save gas on Ethereum transactions

- You can save 20% on gas costs when electing to receive WETH instead of ETH when entering/exiting a liquidity pool on Uniswap / Sushiswap

- Ethereum has a SELFDESTRUCT feature where if you unset your memory variables of a contract and thus store less data on the public blockchain, you earn a rebate on the gas cost of a transaction. This is how the CHI and the GST2 tokens works.

- Stay patient. Anytime you can bid less gas and wait without risking a failed transaction due to a pending trade with a market rate that can change

- If your transactions go through immediately, you’re overpaying for gas!

- Unless you’re aiming to do that because you’re trading, of course.

- Use gasnow.org or monitor the gas meter on Zapper.fi (which also is powered by the API for gasnow.org)

- Use Zaps, DEX aggregators, yield bouncers, and anything you can find that consolidates transactions and saves you gas.

- Always check gas prices seconds before confirming a transaction. You want the most recent price to ensure you bid the price you want.

- If a gas price seems too high, reject it and reconsider if something is wrong. It’s better to wait and reconsider than to submit a transaction mistakenly at a higher gas price.

- You can view historical gas fees paid for providing liquidity (and profit history) with the suite of APY.vision tools.

- You can save time by combining multiple operations with tools such as Zapper and Furocombo

- Some operations are not time sensitive (such as Staking / Unstaking / Get Reward for a farm) while others are (such as Swapping / Adding / Removing Liquidity).

- Consider lowering the gas price when performing operations that are not time sensitive.

Hedge Gas with uGas

- If you think monthly gas prices will rise in the future, you can purchase uGAS-FEB21 or uGAS-MAR21 now on Uniswap

- At the end of each month, uGAS settles at the 30-day median gas price of all ETH transactions.

- If gas costs rise, you redeem your uGAS for a profit and offset your increased gas spending. You’ve effectively used uGAS as a hedge for gas!

Collaboration with Yam and APY.Vision

Yam is a collaborative community innovating at the intersection of decentralized governance and programmable finance. Yam has partnered with UMA to push the bounds of synthetic derivatives on Ethereum to bring you uGAS and Degenerative.Finance.

APY.Vision is an advanced analytics tool for liquidity pool providers and yield farmers. If you’re using any DEXs, AMMs, or liquidity pools this is the tool you will need to easily track the ROI of your liquidity provider and yield farming activities. Try it now!

APY.Vision does not give investment advice and always insists that you do your own research. Read our full Legal Disclaimer.