Explaining Net Market Gains vs. Liquidity Pool Gains

If you’ve come to APY.vision to determine the impact on your liquidity pool position due to swap fees or impermanent loss, you’ve come to the right place! Here at APY.vision, our mission is to deliver the best analytics for our Liquidity Providers (LPs), such as yourself, to understand your gains and losses accurately.

This article explains the difference between Net Market Gains and Liquidity Pool Gains.

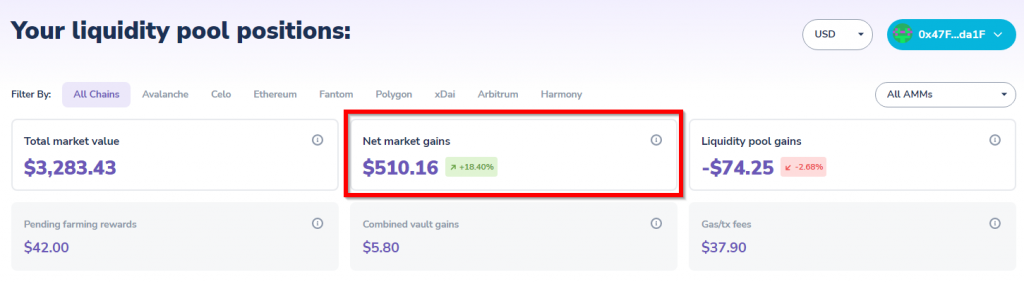

Net Market Gains

Net Market Gains come when the price of an asset in the pool that you are providing liquidity for increases on the open market. Because an LP position still gives you exposure to the underlying asset, you can benefit from the price increase. That is separate from the bonding curve mechanism, which rebalances the number of assets in the pool. Your portfolio could be going up in absolute terms even while experiencing impermanent loss in the pool.

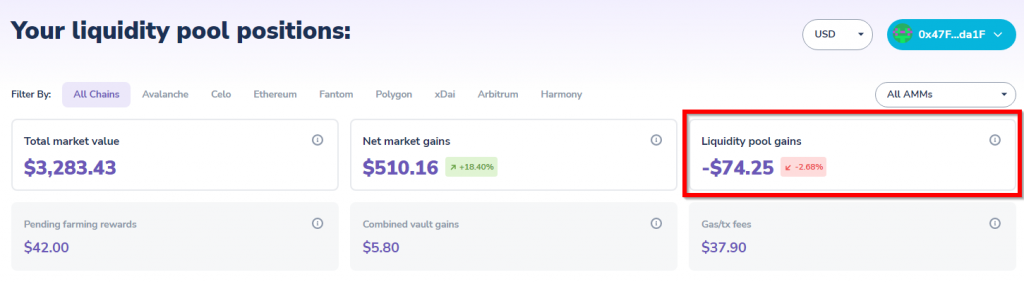

Liquidity Pool Gains

Liquidity Pool Gains are driven by the bonding curve and the swapping of tokens plus any fees you have collected during this time. While you are providing liquidity to the pool, you become subject to impermanent loss depending on the price movement. You also earn a small share of the total fees earned from token trades within the pool.

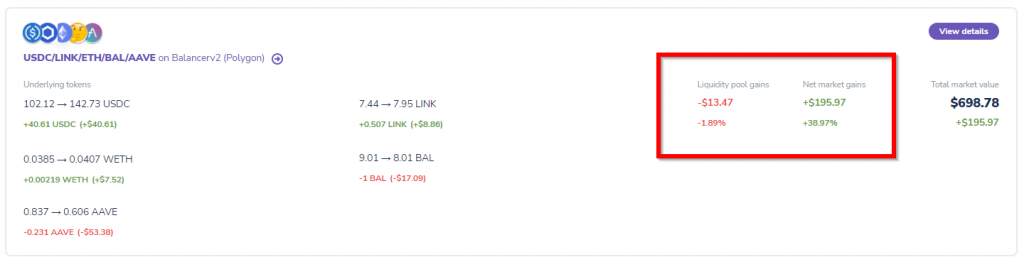

Because of those two distinct mechanisms, many liquidity providers find it helpful to distinguish between performance related to the token price and performance related to the pool’s activity.

In summary, market returns include asset token price appreciation, while liquidity pool gains ignore token price appreciation and factor in revenue earned from pool activity such as swaps in addition to impermanent loss from price volatility.

The Simple Formula

Net Market returns = dictated by an asset price increase/decrease based on the current pool token ratios you hold

Net Liquidity pool returns = dictated by swap fees and impermanent loss in pool

Conclusion

APY.vision provides the portfolio tools for you as a Liquidity Provider to get the most accurate performance information.

If you have any questions or ideas regarding how we make these calculations, please don’t hesitate to reach out to one of us on Discord located at https://discord.gg/ePfGAYbqUq!

Check out APY.Vision!

APY.Vision is an advanced analytics tool for liquidity pool providers and yield farmers. If you’re using any DEXs, AMMs, or liquidity pools this is the tool you will need to easily track the ROI of your liquidity provider and yield farming activities. Try it now!

APY.Vision does not give investment advice and always insists that you do your own research. Read our full Legal Disclaimer.