Using the Advanced Pool Search in APY.vision

How to use the Advanced Pool Search

If you’ve come to APY.vision to look for the best liquidity pool that fits your criteria, you’ve come to the right place!

Here at APY.vision, our mission is to deliver the best analytics for our Liquidity Providers (LPs), such as yourself, to understand your gains and losses accurately. Secondly, we want to provide the best research tools for liquidity pools so you can determine the best pools to provide liquidity in.

In this article, we will describe our advanced search criteria on our Advanced Pool Search.

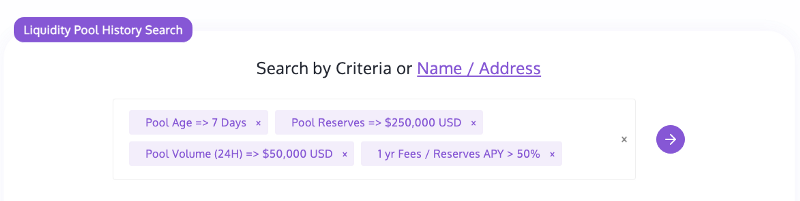

Searching by Criteria

We allow you to search for pools that match specific search criteria based on your investment thesis. Here are the following criteria in more detail:

Pool Age

The length of time the pool has been active. Newly created pools can have risks that are not well understood by the community. Older pools have been at least partially vetted by LP’s for safety. The reason this is important is to prevent the dreaded “rug pull.” A token with a malicious design can be used as pool collateral, luring unsuspecting users to provide liquidity. Once enough liquidity is in the pool, they create an infinite number of tokens to drain the paired asset pool, usually ETH. This can cause you to lose 100% of your liquidity position and is a severe risk.

Also, pools that have a long history will enable better historical analytics.

Pool Volume (24H)

Volume is an essential concern for LPs as it dictates the pool revenue. An LP only makes a commission when swaps are happening. Low volume means low fee revenue, and higher volume means higher fee revenue. For Uniswap, the fee collected is 0.30%, while for Sushiswap, the fee collected on each swap is 0.25%.

Pool Reserves

Pool Reserves tell you the size of the liquidity pool. This is important because your share of the pool reward is proportionate to your ownership stake of the pool. A pool with more extensive reserves means you share the fees with more liquidity providers. A benefit a higher pool reserves is that the slippage is lower, thus reducing Impermanent Loss. A pool with low reserves has more opportunity for fees and a higher chance of slippage, leading to more Impermanent Loss.

You can select the Pool Reserves you’d like to set as a minimum in our search filter.

1y Fees/Reserves Since Inception (APY)

This search filter will allow you to search for the fees collected expressed in APY. This is useful for finding the pools with the highest Annual Percentage Yield from a fees perspective.

Please be informed that a pool can have a high APY in the first week of existence and then drop afterward. Therefore, please ensure you also look at APY’s history in the results and in the details.

Searching by Token Name / Pair Address

If you have a pool you’d like to view, simply paste in the pool’s address, and we will look up the pool by the address. Similarly, if you have a token name you’d like to search for, type in the token symbol, and we’ll explore all the pools that have that symbol.

Conclusion

APY.vision provides the research tools for you as a Liquidity Provider so that you can find the best pool that fits your needs.

If you have any questions or idea regarding how to make the advanced search better, please don’t hesitate to reach out to one of us on Discord located at https://discord.gg/ePfGAYbqUq!

Please note that advanced search is only available for PRO members. To learn more about the PRO edition of APY.vision, please go to https://apy.vision/#/pricing.

Check out APY.Vision!

APY.Vision is an advanced analytics tool for liquidity pool providers and yield farmers. If you’re using any DEXs, AMMs, or liquidity pools this is the tool you will need to easily track the ROI of your liquidity provider and yield farming activities. Try it now!

APY.Vision does not give investment advice and always insists that you do your own research. Read our full Legal Disclaimer.