APY Vision Professional Membership

This post will explain the APY.Vision Pro membership program and how to get access to the professional features of the site.

So, you want to be a liquidity provider?

Money makers in financial markets have traditionally been large firms that controlled great amounts of capital and resources. They provide liquidity to financial markets while commanding a large fee for doing so. It was once difficult to become a market maker without having the intensive capital these select groups of financiers had.

Thankfully, innovations in blockchain technology and Decentralized Finance (Defi) have opened the floodgates to allow anyone, with any amount of spare capital, to contribute liquidity to markets and earn a fee from doing so. This has been enabled through the creation of Automated Market Making (AMM) protocols — a type of decentralized exchange (DEX) protocol that relies on a mathematical formula to price assets. Unlike traditional exchanges, AMMs price assets are based on a pricing algorithm.

We believe that AMMs and DEXes are truly revolutionary concepts that democratize access to investing and we believe will open the doors to a new breed of investors.

As with any revolutionary ideas, there are risks. When using AMMs, there are risks in providing liquidity. While Liquidity Providers receive the upside through exchange fees collected, the downside is the change in allocation for the tokens provided in the pool, which can result in a negative change in the value of the portfolio. This is known as [the dreaded] Impermanent Loss. It’s called Impermanent Loss as while the loss isn’t realized until you sell, the change in the portfolio’s value represents a current day loss. A good Liquidity Provider (LP) needs to be aware of this fact intimately as it impacts their holdings and ultimately, the gains they receive from providing liquidity. However, this can be extremely difficult to track as token prices swing up and down and gains and losses from each liquidity pool varies even minute to minute.

How APY Vision gives you 20/20 vision

Having been LPs ourselves, we experienced firsthand how there was a lack of visibility into an LP’s holdings and your profits and losses. We decided to solve this problem for ourselves by creating a tool that tracks impermanent gains and losses of your pooled tokens, allowing you to have all the analytics you need at your fingertips with actionable insights to ensure you’re in the best pools.

We truly believe AMMs are here to stay and we want to enable anyone, anywhere, who wants to be an LP to have the best information and knowledge they need to become successful in this fast moving, high stakes game of market making.

Become an APY.Vision Pro, hold a token bro

We’ve been inspired by the innovative products being born in the DeFi space and have modeled our pro membership on these projects. To become a APY.Vision Pro member and unlock pro features, hold our membership tokens in your wallet.

Normally, a subscription service costs the same regardless of your level of usage. However, with blockchain technology, we can be a bit more creative and innovative to ensure fair access for all.

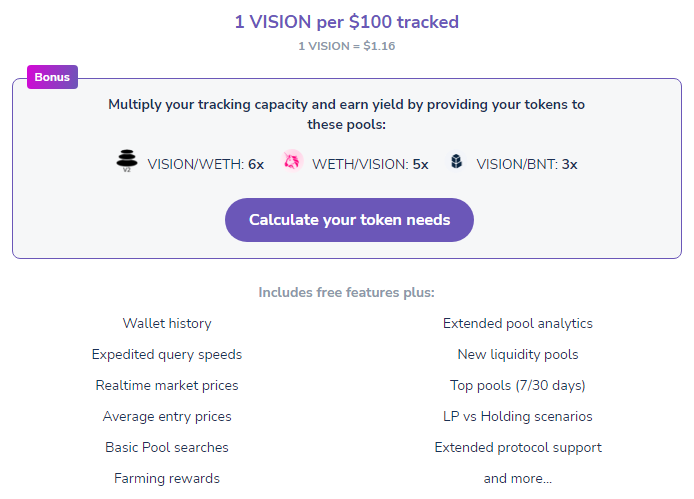

To activate our APY.Vision Pro features, you only need to hold 100 VISION membership tokens per $10,000 of USD tracked in your wallet(s). This ensures that people who are not big portfolio holders can benefit by holding just a small amount of VISION tokens in their wallet. As you provide more liquidity, you can add more VISION tokens to your wallet to activate the pro features — it’s that simple!

As long as you hold VISION tokens or the one of the LP tokens for a boost in your wallet, you will unlock PRO access (for life)!

Tokens — not that big of a deal around here

First and foremost, we’d like to stress that the VISION token is not a security token. The token is designed to not hold value and does not have any inherent value. It is merely a way to unlock subscription access to our APY.Vision Pro features. It is not meant to be speculated on. We are not an ICO or claim to return you any gains by acquiring the VISION token. This is simply a membership token and not an asset.

There is a maximum cap of 5,000,000 VISION tokens.

Acquire Membership Tokens via Balancer on Polygon

You can also get the APY.Vision Pro membership tokens (VISION) via Balancer on the Polygon network by using the “trade” option here –

https://polygon.balancer.fi/#/trade/0x7ceB23fD6bC0adD59E62ac25578270cFf1b9f619/0x034b2090b579228482520c589dbD397c53Fc51cC

You can get a bonus by providing liquidity to the 80/20 VISION-ETH Pool on Balancer, located here –

https://polygon.balancer.fi/#/pool/0x805ca3ccc61cc231851dee2da6aabff0a7714aa7000200000000000000000361

VISION Membership Token Contract:

https://etherscan.io/address/0xf406f7a9046793267bc276908778b29563323996#code

Acquire Membership Tokens via Uniswap

You can get the APY.Vision Pro membership tokens (VISION) via Uniswap by using the “trade” option in the top right here:

https://info.uniswap.org/pair/0xa323fc62c71b210e54171887445d7fca569d8430

FAQ (or the questions you’re too scared to ask)

Where is the contract address?

The contract address is here:

https://etherscan.io/address/0xf406f7a9046793267bc276908778b29563323996#code

If I don’t like the service, can I cancel at any time?

You’ll really hurt our feelings but yes! You can sell it back on to the market if you don’t the service useful. However, before you do this, please join our Discord and tell us why so we can address any issues.

Check out APY.Vision!

APY.Vision is an advanced analytics tool for liquidity pool providers and yield farmers. If you’re using any DEXs, AMMs, or liquidity pools this is the tool you will need to easily track the ROI of your liquidity provider and yield farming activities. Try it now!

APY.Vision does not give investment advice and always insists that you do your own research. Read our full Legal Disclaimer.