How to use Harvest Finance Vaults

In this post we will be showing how to use Harvest Finance Vaults for automated DeFi yield aggregation.

What is Harvest Finance?

Harvest Finance is a yield aggregator that aggregates and automates the process of yield farming. The team is constantly researching and evaluating new projects in order to take advantage of the most profitable yield farming opportunities and add them to their list of vaults and strategies. When looking at new projects they take into consideration many qualitative and quantitative aspects such as; the project reputation, tokenomics, security audits, optimal harvesting methods and more.

What blockchains are Harvest Finance available on?

Ethereum mainnet, Polygon and Binance Smart Chain

What kind of vaults does Harvest Finance have?

Ethereum – Uniswap V2/V3, Balancer, Stablecoins, BTC, ETH 2.0, SushiSwap, Sushi HODL, 1inch, NFT, mStonks, LINK, Seigniorage

Binance – Amplifarm, Pancake, Venus, Goose, Ellipsis, SPACE, Anyswap

Polygon – Quickswap and SushiSwap

Walkthrough guide on using a Harvest Vault

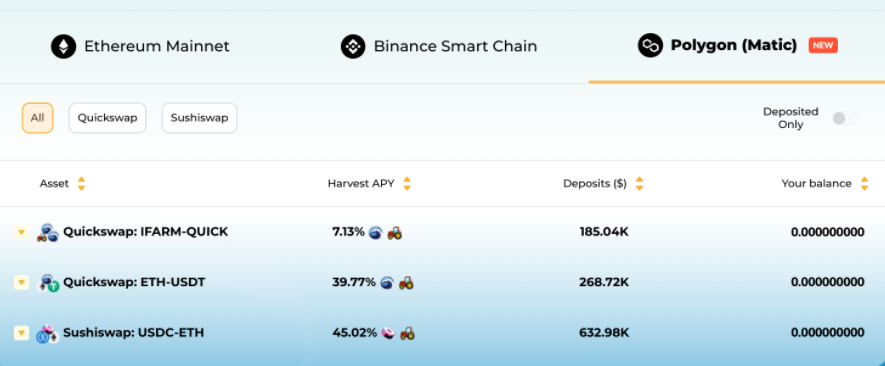

For this example we will be using one of the Harvest vaults on the Polygon network.

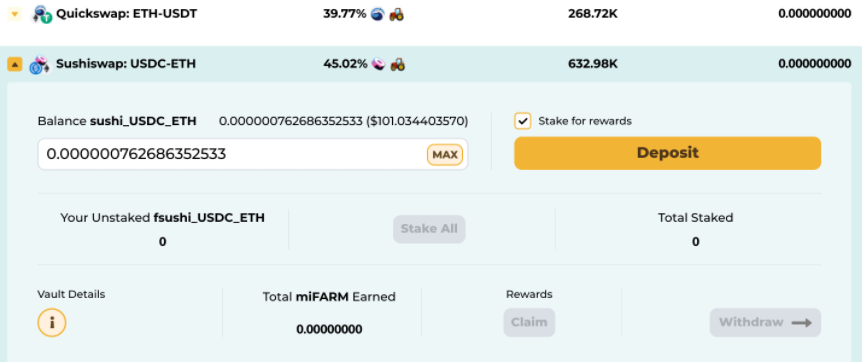

The first thing to look at when selecting a vault is the tab for selecting which chain you are using. You can see the options above for the Polygon network, there are three vaults, two using the Quickswap LP tokens and one using Sushiswap LP tokens.

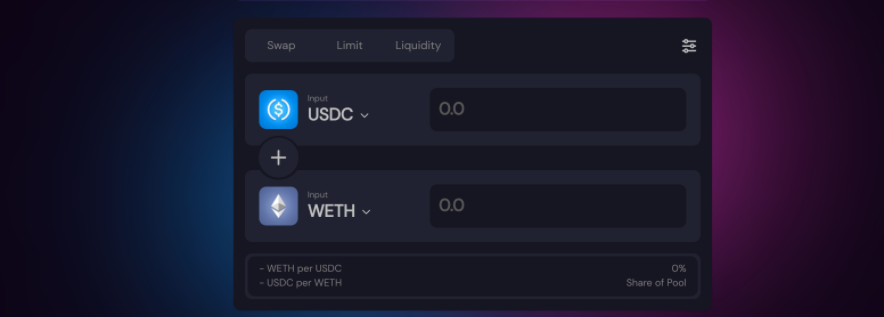

For this exercise we will provide liquidity to the SushiSwap USDC-ETH pool. To enter this Harvest vault, you will need USDC/ETH SushiSwap LP tokens that are in your wallet after going through the liquidity providing process. To find out how to add liquidity to SushiSwap, you can view this article we published on the subject.

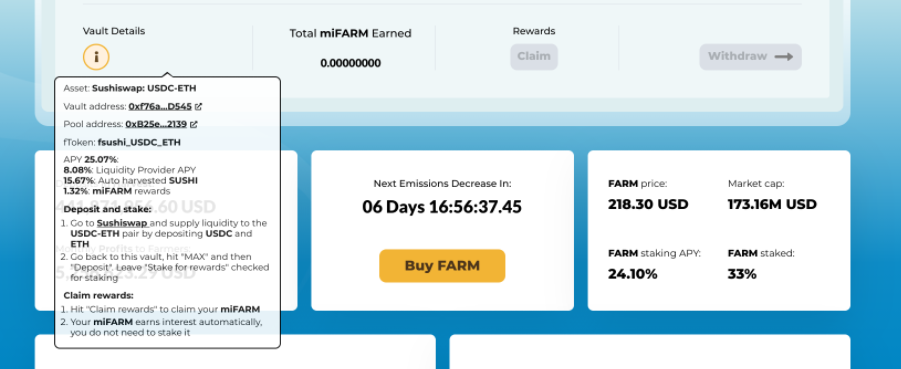

One thing you will notice with Harvest Vault is that if you are browsing through the list of vaults and click on one to expand the details, you will see a section called “Vault Details”. This dialog box will tell you everything you need to know to enter the vault. It will tell you which AMM you need to provide liquidity to, which token pair you need to supply, and other various details that will help you get your funds into the vault and allow you to claim rewards.

Once you have the LP tokens from SushiSwap, you can move to the next step of depositing them on to the Harvest platform.

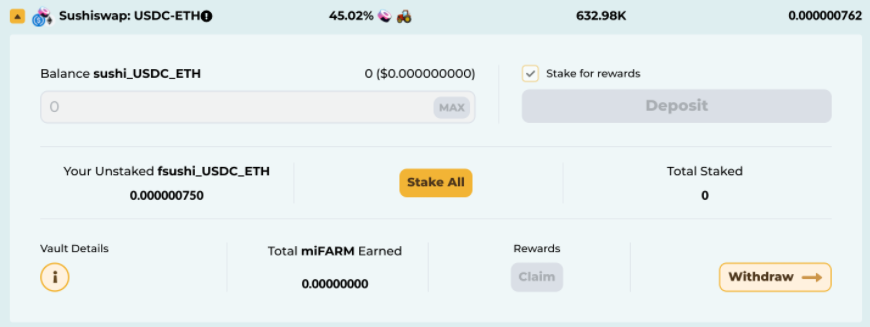

Harvest will display your LP token balance and give you a button to “Deposit” the LP tokens into the vault. Make sure that the box for “Stake for Rewards” is checked to ensure you will be getting the yield farming rewards. Click the Deposit button and confirm the transaction in your wallet to get to the next step. If you encounter an error message, reloading the page is a best practice for trying again. Once the LP tokens have been deposited the screen will look like the picture below.

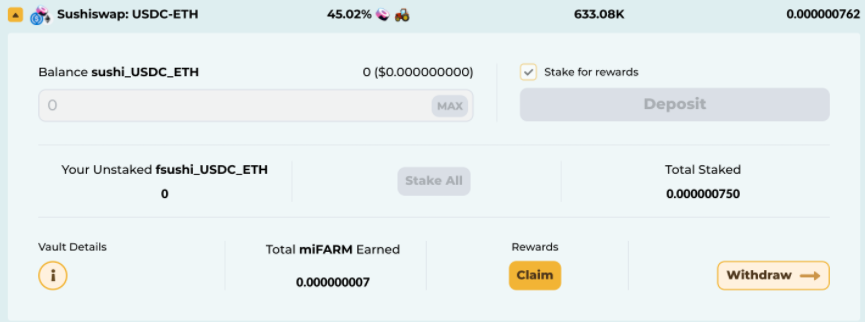

Now that your LP tokens are deposited to the Harvest platform, you have the option to stake your “f” LP tokens (in this case fsushi_USDC_ETH ) to start earning miFARM rewards. Once the f tokens are deposited, the screen will look like the image below giving you the option to claim your miFARM rewards or withdraw from the vault.

How to track your Harvest Vault

Once your funds have been deposited to the Harvest Vault, you can head over to APY.Vision to get detailed tracking information about the token balance changes in the liquidity pool as well as the gains from being in an auto-compounding vault as pictured below.

When you load a wallet with one of the supported vaults, you will see the above interface displaying information about your vault position. You can observe the token balance change as well as see the auto-compounding gains that the vault is performing. If you click on “View details” and click on the “Vault Gains” tab, it will bring you to a screen with more context about your position.

This screen shows “Token gain from vault” which shows the change in the token balance due to the shifting prices within the liquidity pool.

This screen shows how many LP tokens you have gained due to being in the vault.

This screen allows you to see which transactions are going into the calculations. Now you have the information necessary to use Harvest Finance vaults with confidence.

APY.Vision does not give investment advice and always insists that you do your own research. Read our full Legal Disclaimer.

Check out APY.Vision!

APY.Vision is an advanced analytics tool for liquidity pool providers and yield farmers. If you’re using any DEXs, AMMs, or liquidity pools this is the tool you will need to easily track the ROI of your liquidity provider and yield farming activities. Try it now!