How to provide liquidity to SushiSwap on Polygon

In this guide we will explain how to provide liquidity to Sushiswap pools on the Polygon network to earn swap fees and SUSHI rewards.

What is Polygon?

Polygon is a scaling solution for Ethereum with fast and cheap transactions. It is a separate blockchain with different features and parameters which requires moving funds across a “bridge” to get on the Polygon network. The Polygon network uses different technologies than Ethereum Layer 1 so it has a different security model and is able to have lower transaction costs.

What is Sushiswap?

SushiSwap is a fork of Uniswap with the SUSHI token as a focal point. It grants control over the protocol to holders and pays a portion of fees to them and strives to be a community oriented project that rewards its users.

What is the Onsen Menu?

SushiSwap Onsen hosts various DeFi protocols in their liquidity pools to attract users of these protocols to stake their native tokens as liquidity. The “menu” changes frequently and SUSHI tokens are distributed as liquidity mining rewards. The projects on the Onsen Menu typically have the best reward APY’s on the platform.

What you will need to provide liquidity on Polygon Sushiswap

- Metamask wallet

- MATIC tokens in your MATIC wallet for gas

- Two ERC-20 tokens to provide as liquidity on Sushiswap

Setting up the Polygon network with your Metamask wallet

First, you will need to configure your Metamask wallet to connect to the MATIC network. You will need to open Metamask and click on the Network selection dropdown and then click on Custom RPC.

Fill out the empty fields as shown in the picture above and click on Save. You will be directly switched to Matic’s Mainnet now in the network dropdown list. This process adds the MATIC network to the list of available networks you can switch to from within Metamask. Sometimes it is helpful to switch networks when Metamask is acting strange or if you are having trouble getting things to show up.

Here is the list of the parameters so you can easily copy them:

- Network Name: Matic Mainnet

- New RPC URL: https://rpc-mainnet.maticvigil.com

- Chain ID: 137

- Currency symbol: MATIC

- Block explorer URL: https://explorer.matic.network/

Note: There is more than one “RPC URL” you can use to connect to Matic. If the one listed does not work, you can also try one of these URLS listed below.

- https://rpc-mainnet.matic.quiknode.pro

- https://matic-mainnet.chainstacklabs.com

- https://matic-mainnet-full-rpc.bwarelabs.com

- https://matic-mainnet-archive-rpc.bwarelabs.com

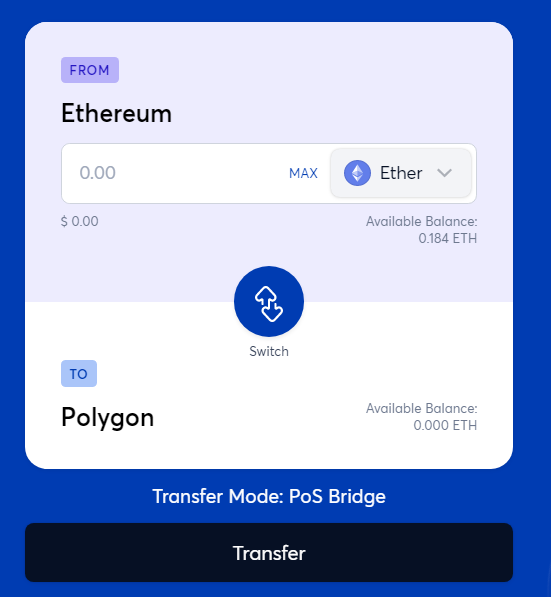

Move funds from ETH network to Polygon network

The Polygon Web Wallet has a button labeled “Move funds to Polygon” and it will bring you to the interface pictured above. Once you have moved funds over to the MATIC networks you can manage them from the same MATIC Web Wallet interface pictured below. This will give you an updated readout of your wallet balances but will not show your liquidity positions once you convert from single assets to LP tokens.

Finding the right pool to provide liquidity to using Sushiswap Onsen Menu

To find the best rewards on Sushiswap click “Yield” at the top of the page to get to the Onsen Menu. Be sure to make sure you are connected to the Matic network in your wallet so the Polygon/Matic version of SushiSwap is the one you are using. The Onsen menu will have the liquidity pools with the most attractive SUSHI rewards, and on MATIC they have created incentives for various pools which you can browse. You will need to click the “Add Liquidity” to get to the interface for adding liquidity.

Steps to add liquidity to Sushiswap

Using this menu you can select a token pair that you would like to provide liquidity to. Remember, you have to put an even proportion of each token into the pool (50/50) and you will typically have to approve each token before you can add liquidity. Luckily on the Polygon network this does not cost very much in gas.

Once you have added the liquidity, you will have Sushiswap Liquidity tokens (SLP) in your wallet that you can manage from the Sushiswap site and then proceed to stake those SLP tokens to start earning rewards.

After you have added liquidity, Sushiswap will give a readout of the token balances that indicate your share of the pool based on how many tokens you entered into the pool as shown below.

Stake your SLP tokens to start earning SUSHI rewards

Once you have the SLP tokens, you can then stake them to earn your SUSHI rewards by hitting the “Approve” button and then once it is approved the button will turn into a “Stake” button. Once it is staked, you will start earning rewards! At the time of this writing, the WETH-DAI pool is earning a 128% APY offering both SUSHI and MATIC reward as you can see in the photo below.

How to withdraw liquidity and what to expect

Much like with Uniswap, when you withdraw your liquidity from the Sushiswap Matic pools you will get back a different number of each token than when you started. That is due to the automatic rebalancing that is a core feature of automated market makers (AMM’s).

You are able to see this process in action when tracking your tokens on APY.Vision. APY.Vision provides real-time tracking that illustrates the impermanent loss or gain of a liquidity pool position as shown below.

To withdraw your liquidity from Sushiswap, you must first unstake the SLP tokens if you had them staked and earning rewards. Once they are unstaked you can hit the “Remove Liquidity” and your SLP tokens will be converted back into the two tokens you initially entered into the pool.

Conclusion

Providing liquidity is a great way to earn some income on tokens sitting in your wallet. You do have to be careful when providing liquidity, as sharp price increases or decreases can have a huge impact on the performance of your position. We suggest using APY.Vision to keep a close eye on your positions to know when to remove liquidity during times of extreme price volatility.

APY.Vision does not give investment advice and always insists that you do your own research. Read our full Legal Disclaimer.

Check out APY.Vision!

APY.Vision is an advanced analytics tool for liquidity pool providers and yield farmers. If you’re using any DEXs, AMMs, or liquidity pools this is the tool you will need to easily track the ROI of your liquidity provider and yield farming activities. Try it now!