5 Interesting stats from the latest Liquidity Review (January-May)

This blog post highlights 5 stats from the latest Liquidity Review Report published by APY.vision. For more insights, download the full report here.

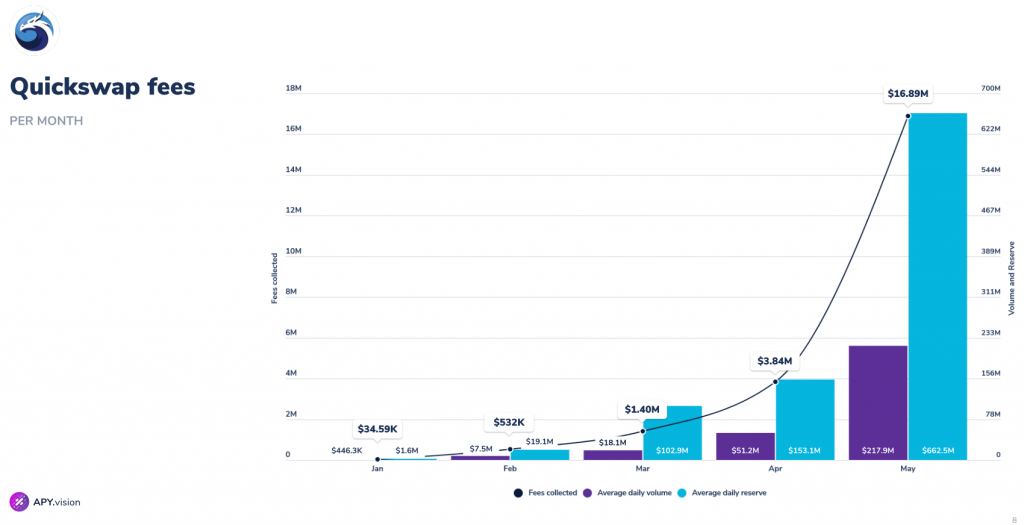

2021 has been a year of exceptional growth for decentralized exchanges and AMM’s. With the launch of the Polygon network competition has ramped up between the various projects. Quickswap was one of the first AMM’s on Polygon and experienced rapid growth in TVL and volume as users flocked to the ultra-fast and cheap MATIC chain.

Quickswap’s exponential growth

QuickSwap experienced rapid growth with the launch of the Polygon chain. QuickSwap was one of the first AMM’s to launch on the Polygon network with an attractive liquidity mining program that drew a lot of capital to their platform.

SushiSwap is taking a bigger chunk from the pie

SushiSwap has done well as one of the main competitors to Uniswap with fees and volume on a significant uptrend. Some of the reasons they are able to attract users are their multi-chain approach and persistent liquidity mining program with the Sushi token as a reward.

Uniswap is still dominant

Uniswap maintained its dominance in the DEX market collecting hundreds of millions of dollars in fees over the period examined. What makes it even more impressive is the lack of a liquidity mining program, indicating that the growth is organic and not subject to wild inflows and outflows typically associated with short lived liquidity mining programs.

High demand for wBTC

Wrapped Bitcoin continues to show that it is in high demand as collateral in DeFi as the largest average daily reserves ($946 Million) are in the SushiSwap WBTC/ETH pool. This highlights the trend of Bitcoin making its way into DeFi via BTC wrapping services.

Rise of the dog tokens

Also noteworthy from this time period was the rise of the Dog tokens like SHIB, which managed to take the 4th spot in the rankings of the pools with the highest volume over the period measured.

Another noteworthy pool was the stablecoin pair of BUSD/USDC (BUSD is a Binance stablecoin) which managed to post a 16% APY on swap fees, even with low volumes and reserve sizes in the Uniswap pool. Stablecoin pairs can be very attractive for investors that want to minimize their exposure to impermanent loss as they typically are immune to large swings in price.

Next report is coming soon!

We plan to issue these reports periodically to take the pulse of decentralized finance and get useful data on the performance of decentralized exchanges (DEX’s) that use automated market maker (AMM) technologies. We are able to leverage the data sources we use for APY.Vision to bring this information to our users.

If there is any information that you would like to see in the next version of the report, drop us a line on Twitter or Discord to let us know!

APY.Vision does not give investment advice and always insists that you do your own research. Read our full Legal Disclaimer.

Check out APY.Vision!

APY.Vision is an advanced analytics tool for liquidity pool providers and yield farmers. If you’re using any DEXs, AMMs, or liquidity pools this is the tool you will need to easily track the ROI of your liquidity provider and yield farming activities. Try it now!