How to provide liquidity to Kyber DMM on Polygon

In this guide we will explain how to provide liquidity to Kyber DMM pools on the Polygon/MATIC network to earn swap fees and KNC rewards.

What is Polygon/MATIC?

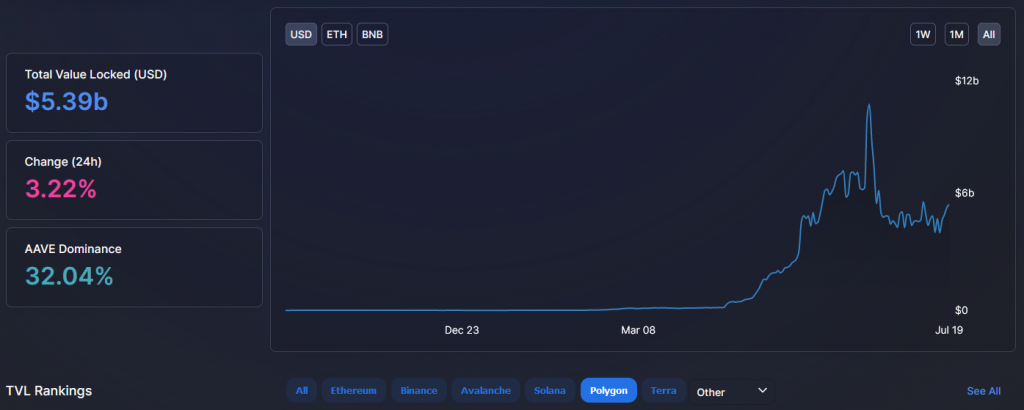

Polygon is a scaling solution for Ethereum with fast and cheap transactions that has grown quickly since it was introduced and currently has about $ 5 billion in total locked value. It is a separate blockchain with different features and parameters which requires moving funds across a “bridge” to get on the Polygon/MATIC network. The Polygon network uses different technologies than Ethereum Layer 1 so it has a different security model and is able to have lower transaction costs

What is Kyber DMM?

Kyber DMM uses technology that acts as a “dynamic automated market making protocol”. The main focus of the DMM is to provide crypto liquidity with high capital efficiency and dynamic fees. This is in contrast to the static nature of typical AMM’s and liquidity platforms. Kyber uses “Amplified Liquidity Pools” and dynamic fees based on market conditions so the protocol can react to token pairs and market conditions to optimize fees for LP’s and traders.

What you will need to provide liquidity on Polygon/MATIC Kyber DMM

- Metamask wallet

- MATIC tokens in your MATIC wallet for gas

- Two ERC-20 tokens to provide as liquidity on Kyber DMM

Setting up the Polygon/MATIC network with your Metamask wallet

First, you will need to configure your Metamask wallet to connect to the MATIC network. You will need to open Metamask and click on the Network selection dropdown and then click on Custom RPC.

Fill out the empty fields as shown in the picture above and click on Save. You will be directly switched to Matic’s Mainnet now in the network dropdown list. This process adds the MATIC network to the list of available networks you can switch to from within Metamask. Sometimes it is helpful to switch networks when Metamask is acting strange or if you are having trouble getting things to show up.

Here is the list of the parameters so you can easily copy them:

Network Name: Matic Mainnet

New RPC URL: https://rpc-mainnet.maticvigil.com

Chain ID: 137

Currency symbol: MATIC

Block explorer URL: https://explorer.matic.network/

Note: There is more than one “RPC URL” you can use to connect to Matic. If the one listed does not work, you can also try one of these URLS listed below.

https://rpc-mainnet.matic.quiknode.pro

https://matic-mainnet.chainstacklabs.com

https://matic-mainnet-full-rpc.bwarelabs.com

https://matic-mainnet-archive-rpc.bwarelabs.com

Move funds from ETH network to Polygon/Matic network

The MATIC Web Wallet has a button labeled “Move funds to Matic Mainnet” and it will bring you to the interface pictured above. Once you have moved funds over to the Polygon/MATIC networks you can manage them from the same MATIC Web Wallet interface pictured below. This will give you an updated readout of your wallet balances but will not show your liquidity positions once you convert from single assets to LP tokens.

Finding the right pool to provide liquidity with Rainmaker Liquidity Mining program

Important notes: Rainmaker rewards are linearly vested over a 30 day period, meaning if you start vesting today and claim after 24 hours you will get 1/30 of your earned rewards. Kyber DMM pools are not always 50-50 pools, the ratio of the token pair changes over time depending on trading activity in the pool.

About “AMP” – Higher AMP means higher capital efficiency within a price range. A higher AMP is recommended for stable coin pairs while a lower AMP is recommended for more volatile non-stablecoin pairs.

Steps to add liquidity to Kyber DMM

Using the “Yield” tab on the Kyber DMM site you are able to select a pool with the token pair you prefer. Once you have selected the pool you would like to deposit into this screen above will appear showing the AMP number and the price ranges associated, as well as the dynamic fee structure. You will have to approve both tokens before you can use the “Supply” button.

After clicking the “Supply” button, you will see a confirmation screen. After confirming your transaction, you will be able to see your LP position in the “My Dashboard” section of the Kyber DMM website. Note: After staking your LP tokens for farming, your LP tokens will no longer appear in the “My Dashboard” section.

Stake your LP tokens to start earning KNC rewards

Now that you have the LP tokens needed to start farming, you can navigate back over to the “Yield” section of the page to “Approve” and the “Stake” your LP tokens to start earning you KNC farming rewards.

Once your tokens are staked, you will be able to “Harvest” your farming rewards at any time. Note: Kyber farming rewards have a 30 day vesting period so you will only receive 1/30th of the rewards per day until the 30 days has passed.

How to withdraw liquidity and what to expect

Much like with other AMM’s, when you withdraw your liquidity from the Kyber DMM pools you will get back a different number of each token than when you started. That is due to the automatic rebalancing that is a core feature of automated market makers (AMM’s).

You are able to see this process in action when tracking your tokens on APY.Vision as it provides real-time tracking that illustrates the impermanent loss or gain of a liquidity pool position so will have an idea how many tokens you will receive when pulling your liquidity out of the pool.

To withdraw your liquidity from Kyber DMM, you must first unstake the LP tokens if you had them staked and earning rewards. Once they are unstaked you can navigate to the “My Dashboard” and manage your LP position from there, allowing you to withdraw or deposit more liquidity.

Track your position with APY.Vision

Providing liquidity is a great way to earn some income on tokens sitting in your wallet. You do have to be careful when providing liquidity, as sharp price increases or decreases can have a huge impact on the performance of your position. We suggest using APY.Vision to keep a close eye on your positions to know when to remove liquidity during times of extreme price volatility.

APY.Vision does not give investment advice and always insists that you do your own research. Read our full Legal Disclaimer.

Check out APY.Vision!

APY.Vision is an advanced analytics tool for liquidity pool providers and yield farmers. If you’re using any DEXs, AMMs, or liquidity pools this is the tool you will need to easily track the ROI of your liquidity provider and yield farming activities. Try it now!