How to provide liquidity on Balancer V2

In this guide we will explain how to provide liquidity to Balancer pools to earn swap fees and BAL rewards.

What is Balancer?

Balancer is a decentralized exchange that can act as an automated portfolio manager, liquidity provider and price sensor, highlighting the flexibility of the protocol. Balancer is based on an N-dimensional invariant surface, a generalization of the constant product formula described by Vitalik Buterin and used by Uniswap.

Difference between Balancer and other AMM’s

One of the unique features of Balancer is multi-asset “Weighted Pools” (up to 8 assets) with each token being assigned a weight defining what fraction of the pool is made up by each asset. This differs from the Uniswap 50/50 pools that are limited to two assets. Balancer also recently released “Stable Pools” with a more efficient design similar to Curve. They also allow for “nested pools”, which are pools made up of other pools.

Balancer V1 introduced a flexible fee structure for creators of pools (0.0001% – 10%) that gives more fee options than liquidity provided on Uniswap v2 or Uniswap v3 (which gives you the option to choose between three fee tiers). Balancer V2 is also pioneering the use of “Dynamic Swap Fees” which are optimized by the Gauntlet team and allows swap fees to be adjusted based on market conditions to help find the optimal fee rate.

What are the improvements for Balancer V2?

One of the first improvements users of V2 will see is the updated front-end that is a part of the overall upgrade that prioritizes security, flexibility, capital efficiency and gas efficiency. The vault architecture abstracts all trading logic to pools, and lets the vault handle all intermediate swaps involved in a multi-hop trade. This allows the vault to reduce swap fees by transferring the minimal necessary amount. V2 has also made progress on improving the gas cost for a simple token swap, seeing 40-50% reductions in gas costs in testing.

Here is the list of improvements and new features in Balancer v2:

- Protocol Vault for all Balancer pool assets

- User Balances (like a personal “wallet” inside the Vault)

- Improved gas efficiency

- Flash Loans

- Flash Swaps (arbitrage trading with no initial investment)

- Custom AMM formulas

- Capital efficiency through Asset Managers

- Low-gas-cost and resilient oracles

- Community-governed protocol fees

What you will need to provide liquidity on Balancer on Ethereum

- ETH to pay for gas fees

- ERC20 tokens for depositing into pools

- An Ethereum address you can use with a wallet like Metamask

Finding the right pool to provide liquidity on Balancer

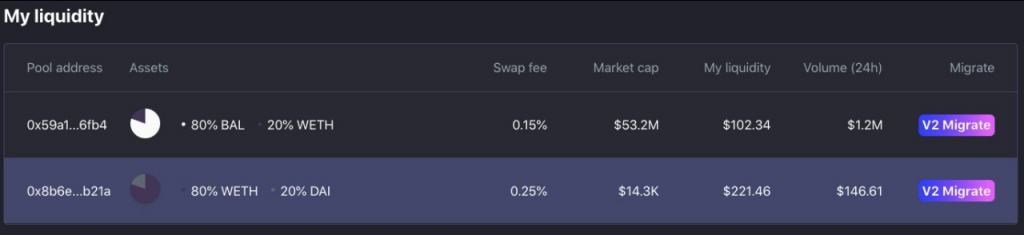

Balancer V1 pools are no longer incentivized with liquidity mining, and as V2’s TVL grows the swap fees revenues in V1 tend to go down. Liquidity providers can easily move their assets to similar pools in V2 via a migration tool on the V1 app , or withdraw from V1 and reinvest in a different composition in V2.

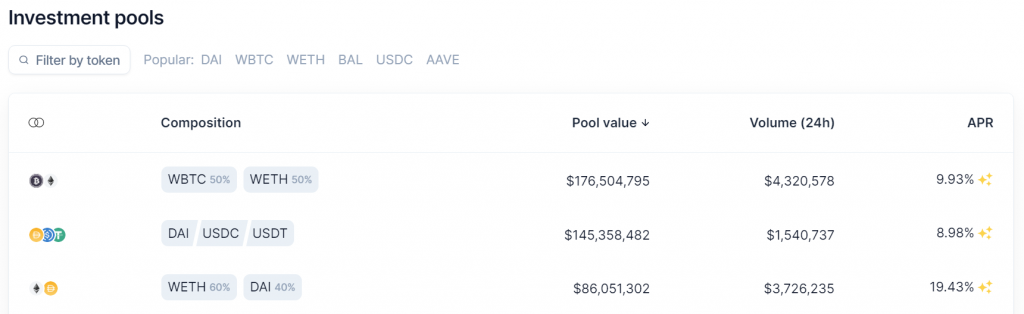

There are two important metrics to look at when evaluating Balancer pools, “Swap Fee APR” and “Liquidity Mining APR”.

You will be able to see those two rates when hovering your mouse over the yellow shapes next to the box labeled “APR”. The liquidity mining APR is issued in the BAL token and is usually much bigger than what you will see from swap fees. You can deposit into a Balancer pool with only one of the tokens in the pool, and the pool will automatically convert your deposit into the other tokens that comprise the pool weights. It works the same way when exiting a pool, you can either withdraw a single token or the weighted distribution of the tokens.

Balancer pools earn fees from trading activity in the token pairs. Fees can be set by the pool creator or dynamically optimized by Gauntlet. It is important to note that much like Uniswap, at some point in the future governance can choose to vote in a systemwide “Protocol Trading Fee” which is a percentage of the pool trading fees.

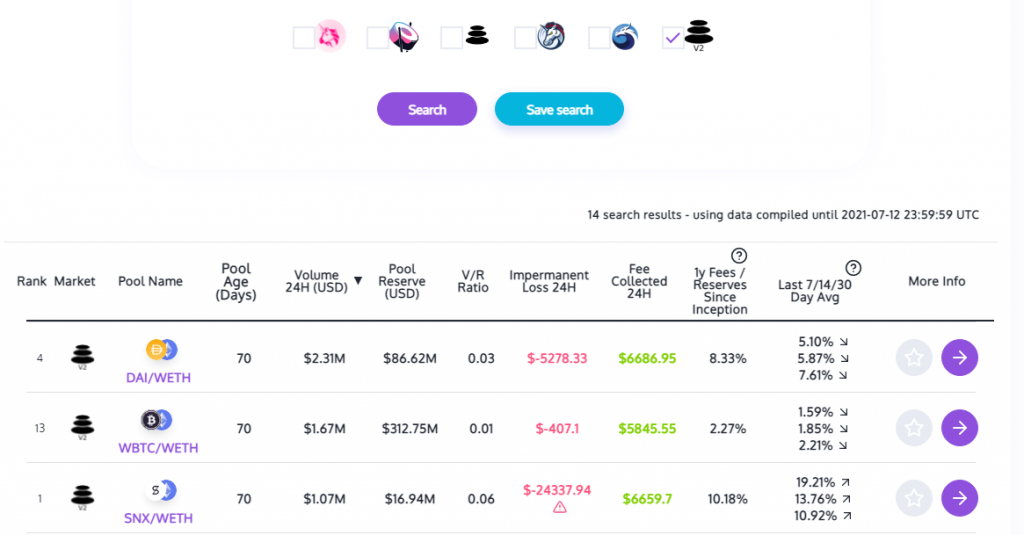

You can also use APY.Vision to compare the numerous Balancer V2 pools using the pool search function which allows you to sort the pools based on various metrics like pool age, 24 hour volume, reserve size and more.

Steps to add liquidity to Balancer

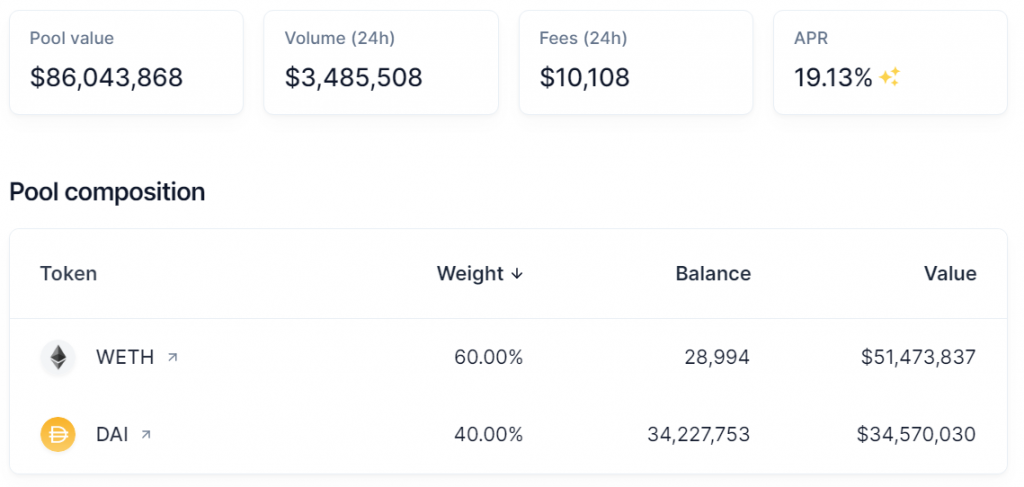

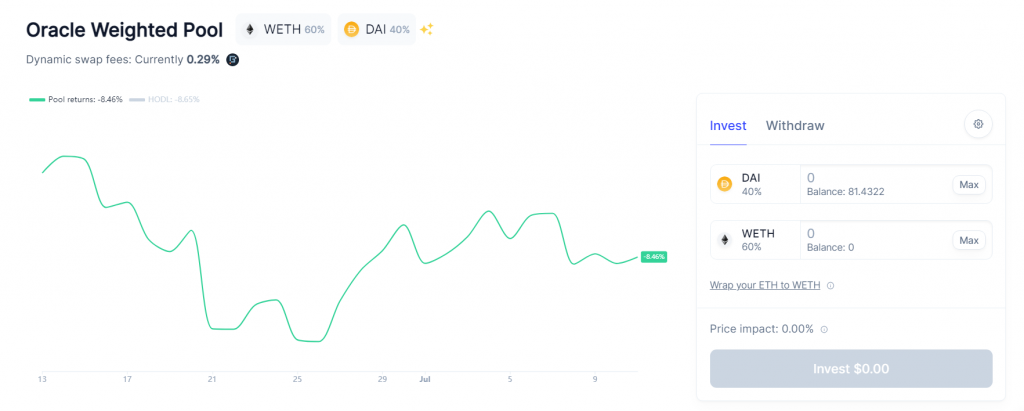

- After you have selected a pool you would like to make a deposit into, once you click on that pool you will be presented with a dialog box that will ask you to “Approve” one or each of the token you intend to deposit. You do not need to have every token in the pool, you just need to deposit one of them and Balancer will auto convert the deposit into the weights of the pool (In this case I deposited DAI, which was converted to 60% WETH and 40% DAI )

2. Once you have approved the tokens for deposit you will be presented with an “Invest” button that will trigger the transaction in your wallet.

3. Once the transaction is complete you will be shown this screen that shows you the “Receipt” via a link to Etherscan for that transaction.

4. You can then navigate to the Balancer dashboard by clicking the Balancer logo in the top left of the page to view your Balancer V2 liquidity pool positions.

5. When it comes time to withdraw, you again have the option of dealing with a single token or with the distribution of the tokens for the weights of the pool. If I would have chosen this option I would have received back 40% of my deposit in DAI and 60% in WETH (Wrapped Ether)

6. The other option is to use the “Single token” withdrawal option, which allows you to receive 100% DAI or 100% WETH upon withdraw.

Track your position with APY.Vision

Providing liquidity is a great way to earn some income on tokens sitting in your wallet. You do have to be careful when providing liquidity, as sharp price increases or decreases can have a huge impact on the performance of your position. To read more about the risks, we highly recommend reading this post. We suggest using APY.Vision to keep a close eye on your positions to know when to remove liquidity during times of extreme price volatility.

APY.Vision does not give investment advice and always insists that you do your own research. Read our full Legal Disclaimer.

Check out APY.Vision!

APY.Vision is an advanced analytics tool for liquidity pool providers and yield farmers. If you’re using any DEXs, AMMs, or liquidity pools this is the tool you will need to easily track the ROI of your liquidity provider and yield farming activities. Try it now!