Everything You Need to Know About Uniswap LP NFTs

Uniswap v3 brought a significant change to liquidity providing. In this blog post, we’re sharing everything you need to know about the new Uniswap LP NFTs.

About Uniswap v3 in short

Uniswap v3 now supports positions with multiple fee tiers and concentrated liquidity ranges. Instead of just picking an equal value of two tokens, you can select your preferred fee tier in any liquidity pool. By default, Uniswap provides three fee tiers you can choose from. This has led to massive increases in potential capital efficiency by the latest version of DeFi’s most popular AMM.

Uniswap v3 also introduced liquidity concentration, which means that you can set a certain price range where you provide liquidity. This is a way of decreasing your impermanent losses. This range means you earn fees if the market price is within your selected range.

One of the aspects of this new system is that liquidity providers will need to move their price ranges in volatile asset pairs to optimize returns. This can make providing liquidity cost-prohibitive for providers with less capital due to gas costs associated with adjusting ranges. Uniswap plans to address this issue when they release the Arbitrum and Optimism Layer 2 solutions.

Providing liquidity on Uniswap v3 requires a more active presence compared to the earlier version of the platform. Recent analysis has shown that active providers will most likely outperform passive liquidity providers. There are currently services being built that will handle the active management to remove the complexity for liquidity providers looking for a passive solution. One such solution is being built by Visor Finance and you can read more about their performance in this twitter thread.

About the Uniswap LP NFT

On Uniswap v3, liquidity provider (LP) positions are represented as NFTs (ERC-721 tokens) as opposed to the fungible ERC-20 tokens on Uniswap V1 and V2.

Based on the pool and your parameters selected on the liquidity providing interface a unique NFT will be minted representing your position in that specific pool. As the owner of this NFT, you can modify or redeem the position.

The best part?

This NFT comes with a unique piece of on-chain generative art. Uniswap v3 NFT’s are SVGs generated entirely on-chain and derived from the properties of the underlying position

What info can you read on a Uniswap LP NFT art?

The NFT art shows the most important info about your liquidity position. You can view your Uniswap v3 NFT inside the Uniswap app when you view your LP position.

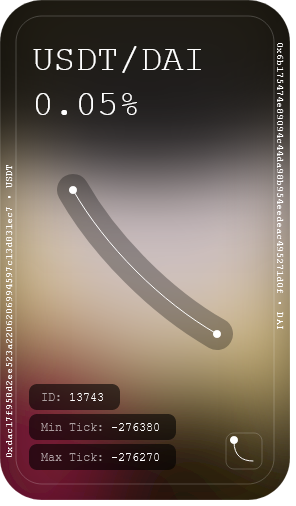

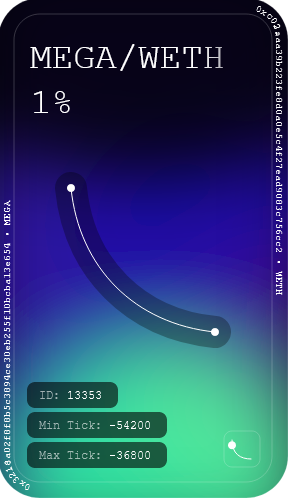

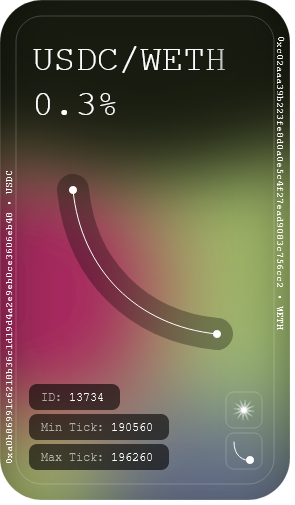

On the top of the NFT, you will see the pair symbols, and right below it the selected free tier. On the side, the token symbols and the pool’s address are moving around.

In the middle, you can find a curve. Tokens on Uniswap are sold on a bonding curve and the design indicates the steepness of this curve, which is impacted by where the liquidity providers decide to set their ranges in v3. The shape of the curve is derived from the liquidity concentration as well as the ratio at which the tokens were initially deposited.

The color scheme of the NFT is based on the two underlying tokens, but the color distribution is unique per token id so each is unique but they are themed per pool.

Stable pool example:

Random example:

Under the curve, you can find the ID of your NFT and also the min and max price range the liquidity provider set up.

The small icon in the lower right corner shows the LPs position in the curve (the position of the price range) where the liquidity provider is active in the pool.

In some cases, you can see a small sparkle above this small curve icon:

What does this sparkle mean?

The sparkle on the NFT is a rare attribute and has a small chance of being generated that is reduced as token ID increases (~10% at ID 100, ~3% at ID 100k)

Discover other Uniswap LP NFTs

Since the NFTs are minted on the Ethereum blockchain, you can use Etherscan to check out the smart contract and the NFT minting transactions.

When clicking on the transaction, you can see more details about the underlying liquidity provider position:

So how to get these NFTs? You guessed it, provide liquidity on Uniswap v3. To learn more about how to provide liquidity on Uniswap, follow our guide here (link to our post).

If you want to browse the Uniswap LP NFTs, check them out on Opensea. You can also see them by visiting this Etherscan link

You can even randomly generate NFT arts or create your own by manually adjusting its parameters using this cool tool: https://uniswaplpart.com/. This is just for visual entertainment, the cards generated here aren’t on the blockchain.

Can you sell these NFTs?

The short answer is yes.

But keep in mind that this NFT represents your ownership of your liquidity position.

If you decide to sell your NFT for 1 ETH, which represents a liquidity position worth 100 ETH then the new owner of the NFT will have ownership of your provided LP tokens – they can withdraw your liquidity.

During the early days of v3 liquidity providing someone created a Uniswap v3 LP position worth 127,000 USD and accidentally or intentionally sold the NFT representing that liquidity for 1 ETH. Ugh

What happens when you remove your liquidity from the pool?

You can only remove the liquidity if you have its NFT in your wallet. During the liquidity removal process, the NFT will be burned along with your liquidity positions and you will get your tokens back. If the price stays in your set range, you will get both tokens back. If the price went out of range you will receive back your position 100% in one token.

Conclusion

Uniswap LP NFTs are simply gorgeous. But keep in mind that these aren’t just simple NFT arts since they also represent your ownership of your tokens provided to the pool. Keep your NFTs safe and don’t sell them under their market value.

APY.Vision does not give investment advice and always insists that you do your own research. Read our full Legal Disclaimer.

Check out APY.Vision!

APY.Vision is an advanced analytics tool for liquidity pool providers and yield farmers. If you’re using any DEXs, AMMs, or liquidity pools this is the tool you will need to easily track the ROI of your liquidity provider and yield farming activities. Try it now!