How To Invest In Liquidity Pools

In this post, we’re covering the following methods of entering liquidity positions:

Uniswap | Balancer | Sushiswap | Zapper | Argent | Zerion

APY.Vision can accurately track your profit or loss from investing in liquidity pools by having the best available data on fees and impermanent loss. Below are the various ways you can acquire liquidity providing tokens (commonly known as LP tokens) that we can help you track on our platform.

Uniswap

1. You will need to hold the two assets you would like to use for liquidity providing in your ERC-20 compatible wallet (Uniswap supports — Metamask, WallectConnect, Coinbase Wallet, Fortmatic, Portis). If you would like to supply $1000 to the ETH/USDC pool, you would need $500 ETH and $500 USDC, plus some extra ETH to cover gas costs. You can check current gas prices at Gasnow.org.

2. Navigate to the Uniswap App page, connect wallet and select Pools from the top menu

3. Click the “Add Liquidity” button and select the pool you want to invest in by selecting the two assets that comprise the pool in the Uniswap interface — NOTE: It is important to verify you have the correct assets selected (many have similar names), you can verify that information using Etherscan, CoinGecko and Uniswap.info.

4. Uniswap will quote some current token prices and your projected share of the pool before you hit the Supply button. Once you hit “Supply”, the two assets in your wallet will be exchanged for Uniswap LP tokens, representing your share of the liquidity pool. The tokens will start to earn you fee revenue and expose you to potential impermanent loss.

Balancer

1. Balancer works a lot like Uniswap but allows you to have pools with different asset ratios than 50/50, like 95/5 or 80/20. Balancer has a Swap page and a Add Liquidity page, you want to go to the Liquidity page that allows you to enter pools. You will then need to connect your ERC-20 compatible wallet. (Balancer supports — Metamask, WallectConnect, Coinbase Wallet, Fortmatic, Portis).

2. Once your wallet is connected you can browse the various pools in the “Explore pools” tab and select which pool you would like to enter. Each pool will provide options for statistics in order to help make your decision easier. Balancer allows for single asset deposits in the pool, meaning you do not have to hold both pool assets to enter. It is worth nothing that slippage is a big concern in pools with low liquidity.

4. Click the “Add Liquidity” button to determine the parameters of your pool investment. Once you have entered the token amounts you would like to invest, Balancer will give you a summary of the swap fee charged in the pool and the amount of BPT you will receive. The BPT token is a reward for providing liquidity to the pool.

Sushiswap

- Sushiswap is a fork of Uniswap with some added features and incentives. Much like UNISWAP you will need to hold the two assets you would like to use for liquidity providing in your ERC-20 compatible wallet (Uniswap supports — Metamask, WallectConnect). If you would like to supply $1000 to the ETH/USDC pool, you would need $500 ETH and $500 USDC, plus some extra ETH to cover gas costs. You can check current gas prices at Gasnow.org.

- Navigate to the Sushiswap app page, connect wallet and click the “Overview” section of the men and you will see an input box labeled “+ Liquidity”. That is the interface for joining the LP pool. One of the unique features of Sushiswap is their menu system for finding liquidity pools that offer farming rewards. The farming rewards are tokens that are issued to liquidity providers. You also have the ability to migrate your Uniswap LP tokens into the Sushiswap system.

NOTE: It is important to verify you have the correct assets selected (many have similar names), you can verify that information using Etherscan, CoinGecko and Uniswap.info.

4. Once you hit “Supply”, the two assets in your wallet will be exchanged for Sushiswap LP tokens, representing your share of the liquidity pool. The tokens will start to earn you fee revenue and expose you to potential impermanent loss.

Zapper

Zapper is a non-custodial DeFi management interface that has some options that allow you to invest in liquidity pools.

- Connect ERC-20 compatible wallet. (Zapper supports Metamask, WalletConnect, Ledger, Lattice, Trezor, Fortmatic, Portis, Torus, Opera, Authereum, WalletLink/Coinbase Wallet, Dapper)

- Once you are connected use the side menu to navigate to the “Invest” section. You can then select which pool you are going to provide liquidity to.

3. A useful feature of Zapper is the ability to add liquidity to a pool using a single asset. That means you purchase any pool with an amount of USDC or any other stablecoin. Zapper supports ETH, DAI, USDC, USDT, LINK, WBTC and WETH for these types of single asset swaps.

4. The assets in your wallet will be exchanged in whichever pool you selected, representing your share of the liquidity pool. Be mindful ZAPPER allows you to select from many different protocol pools (Curve, Balancer, Yearn, Uniswap, Sushiswap). The tokens will start to earn you fee revenue and expose you to potential impermanent loss.

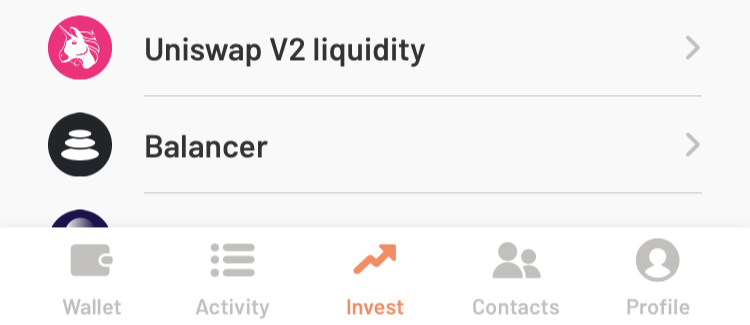

Argent

Argent is a mobile smart wallet that you can find on the Apple Store and the Android store. It has support for many DeFi protocols including Balancer and Uniswap for investing in liquidity pools.

- Make sure you have some assets to swap in your Argent wallet and browse through the pools they have available via the application. Find the pool you would like to enter and click “Buy Investment” and the pool tokens will show up in your wallet.

- The assets in your wallet will be exchanged in whichever pool you selected, representing your share of the liquidity pool. The tokens will start to earn you fee revenue and expose you to potential impermanent loss.

Zerion

- Zerion is a non-custodial DeFi management interface that has some options that allow you to invest in liquidity pools. ZERION supports Fortmatic, WalletLink/Coinbase Wallet, WalletConnect and Portis.

- Once you are connected navigate to the “Pools” section and select the pool you would like to invest in.

3. A useful feature of Zerion is the ability to add liquidity to a pool using a single asset. That means you purchase any pool with an amount of USDC or any other stablecoin. Zerion supports ETH, DAI, USDC, USDT, TrueUSD and WETH for these types of single asset swaps.

4. The assets in your wallet will be exchanged in whichever pool you selected, representing your share of the liquidity pool. The tokens will start to earn you fee revenue and expose you to potential impermanent loss.

Check out APY.Vision!

APY.Vision is an advanced analytics tool for liquidity pool providers and yield farmers. If you’re using any DEXs, AMMs, or liquidity pools this is the tool you will need to easily track the ROI of your liquidity provider and yield farming activities. Try it now!

APY.Vision does not give investment advice and always insists that you do your own research. Read our full Legal Disclaimer.