How to provide liquidity to Solidly and Solidex on Fantom

In this guide we will explain how to provide liquidity to Solidly and Solidex on Fantom to earn yield farming rewards.

What is Fantom?

Fantom is a high-performance, scalable, and secure smart-contract platform. It is designed to overcome the limitations of previous generation blockchain platforms. Fantom is permissionless, decentralized, and open-source. It uses a novel aBFT consensus mechanism called Lachesis which allows Fantom to be much faster and cheaper than older technologies, yet extremely secure.

What is Solidly?

Solidly allows low cost, near 0 slippage trades on uncorrelated or tightly correlated assets. The protocol incentivizes fees instead of liquidity. Liquidity providers (LPs) are given incentives in the form of SOLID tokens. Solidly is the latest project from Andre Cronje, of previous Yearn Finance fame.

What is Solidex?

Solidex is to Solid, what Convex is to Curve. The concept is straightforward:

Liquidity providers deposit their LP tokens into Solidex to earn boosted SOLID rewards without having to lock SOLID themselves. SOLID lockers earn a portion of the protocol revenue in exchange for providing boost to LPs. The native $SEX token entitles users to their share of protocol revenue and voting power. Although Solidex builds upon existing DeFi concepts, we are proud to announce that we are not merely a fork. Our codebase is built from scratch specifically to integrate with Solid — it is not an adaptation of Convex or another protocol.

“Introducing Solidex— A native Fantom protocol”

What you will need to provide liquidity on Solidly on Fantom

- Metamask wallet

- FTM tokens in your Fantom wallet for gas

- Supported tokens to provide as liquidity on Solidly

Setting up the Fantom network with your Metamask wallet

Much like with the Polygon network, you can use Metamask to interact with Fantom. There is a web wallet you can use to monitor your balances. It was created as a Progressive Web App (PWA) to make it easier to launch on all major platforms.

To configure your MetaMask to have the ability to access the Fantom network you need to click the icon in the top right corner and select “Settings”. Once there, find the tab labelled “Networks” and when you arrive there you should see a button to “Add Network” where you can input the settings below:

Here is the list of the parameters so you can easily copy them:

- Network Name: Fantom Opera

- New RPC URL: https://rpc.ftm.tools/

- Chain ID: 250

- Currency symbol: FTM

- Block explorer URL: https://ftmscan.com

This process adds the Fantom network to the list of available networks you can switch to from within Metamask. Sometimes it is helpful to switch networks when Metamask is acting strange or if you are having trouble getting things to show up.

Move funds from ETH or Polygon/Matic networks to the Fantom chain

Key takeaway: Moving stablecoins to Fantom is cheap and easy, moving FTM is a bit more difficult. You can get a small amount of FTM if you have none from an FTM faucet.

A website called Fantom Community Alerts has set up a faucet to distribute FTM tokens to new users of the platform so they have enough FTM to make their first trade. You can find it in the section of their page with the label “FTM Faucet”. This is helpful if you are only using the stablecoin bridge mentioned below and have no FTM in your wallet to make the first transaction.

To move funds from ETH mainnet to the Fantom network, you must first own some FTM tokens on Ethereum, you can purchase them on Uniswap or Sushiswap. You can then use a service called Multichain.xyz to swap the FTM to the Fantom chain by selecting FTM (ETH) and FTM (Fantom) in the interface and performing the swap. Be aware that this method has Minimum and maximum amounts for swap sizes and fees. The minimum fee is 80 FTM so be sure that you are swapping enough tokens to make it worth the 80 FTM.

Using a service called xPollinate (which is powered by Connext and 1Hive) you can easily move stablecoins like DAI, USDT and USDC from the Matic chain to the Fantom chain. They currently support moving stablecoin funds back and forth between xDAI, Polygon, Fantom and Binance Smart Chain. This service is dependent on the availability of exit liquidity for each of the chains, which they display below the main swap interface. At the time of writing, there was plenty of exit liquidity for most of the chains except Polygon/Matic.

Finding the right pool to provide liquidity on Solidly

You can add liquidity to any token pair trading on Solidly. The interface does not currently show the farming opportunities but you can find attractive APY’s using Solidex, a yield optimizer built for use with Solidly. The relationship between Solidly and Solidex is very similar to Curve and Convex. Below are some of the available farming opportunities on Solidex. In order to enter these farms you must first provide liquidity to Solidly without staking the LP tokens. You will be staking them on Solidex to maximise the yield.

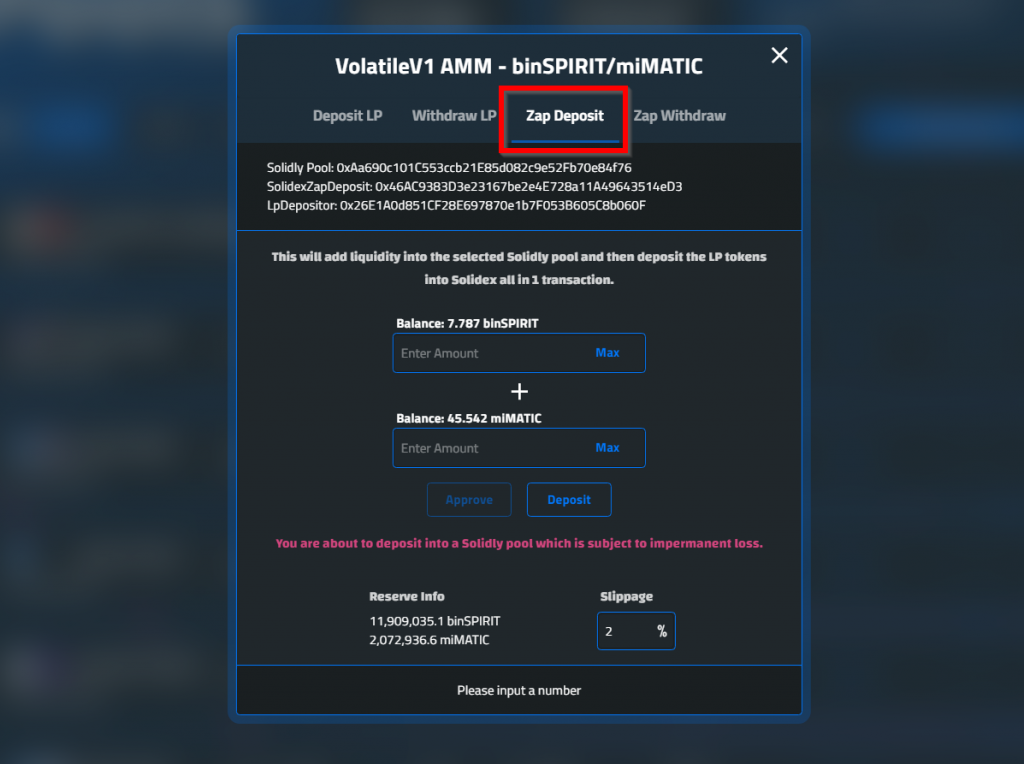

EDIT: Zaps now available on Solidex!

If you have the two tokens needed for a pool in your wallet, Solidex has added a feature that will automatically take those tokens and provide them as liquidity on Solidly and will stake those LP tokens on Solidex, all in one transaction. You will find this option when you click “Manage” on any given pool listed on Solidex.

Steps to add liquidity to Solidly

Note: If you have not previously interacted with a token you may have to do an “Approve” transaction before any of the steps listed in this process.

In order to invest in one of the pools featured you will need to have at least one of the tokens from the pool in your wallet. In this example we will use BOO to deposit into the pool using the “Add Liquidity” button on the “Liquidity” page. Given that we are entering the BOO/xBOO pair, we need to have equal proportions of each token, 50% of BOO and 50% of staked BOO on the SpookySwap platform which is where xBOO is generated.

Once you hit the “Add Liquidity” button you will be shown the screen below where you can input the amount of tokens you would like to deposit. You will ned to select “Stable” if the pool consists of stablecoins. This pair has no stablecoins to it is considered an “volatile” pair.

Once you have entered the amount you would like to deposit, hit the “Advanced” toggle switch and you will be shown the screen below.

Hit the “Deposit LP” button and your tokens will be deposited and exchanged for LP tokens which represent your share in the liquidity pool. You can then bring these tokens over to Solidex to stake them.

You can manage your Solidly pools in the “Rewards” section of the site, but because we are not staking on the Solidly platform but rather the Solidex platform, you will not see much activity here.

Stake your Solidly LP tokens on Solidex to start earning boosted SOLID and SEX rewards

Once you have your Solidly LP tokens you can then use them to stake and earn SOLID and SEX rewards on Solidex. You can see in the picture above the “Manage” button, press that button and “Approve” the pool and then you will be able to “Deposit” your LP tokens.

Once you have staked your LP tokens you can manage them from the same screen in the “Pools” section of Solidex. There is a “Claim All Earnings” button that will collect your rewards and deposit them into your wallet. Happy Farming!

Track Your Position With APY.vision

First time APY.vision users – enter your Fantom address in the box highlighted above. On mobile/tablets click on the search icon and copy their address into the popup

Once your liquidity position is deposited on Solidly, you can start tracking the performance of the vault. You can see in the picture below that APY.vision will track the shift in the token balances in the pool. For more details on a given position you can click the “View Details” button to get even more analytics and information about your position.

How to withdraw liquidity from Solidex and Solidly and what to expect

When you are ready to pull your liquidity from the Solidex farm, you must first hit the “Manage” button pictured above on the Solidex Pools page and the dialog box below will pop up to withdraw it from Solidex. This action will harvest your SOLID and SEX rewards at the same time it unstakes the LP token from the staking contract.

After you have unstaked your LP tokens, you will need to go back to Solidly to fully remove the liquidity from the Solidly pool. Navigate to the “Liqudity” tab once again and hit the “Add Liquidity” button pictured below.

After you hit the “Add Liquidity” button from the previous step you will be shown this screen which has a tab for “Withdraw”. Hit “Unstake and Withdraw” to exit the Solidly pool. Note: your liquidity will not appear here until it is removed from Solidex first.

After performing the transaction you will get the two assets back in your wallet that you originally entered the pool with. After this step the exit process is complete!

Conclusion

Providing liquidity is a great way to earn some income on tokens sitting in your wallet. You do have to be careful when providing liquidity, as sharp price increases or decreases can have a huge impact on the performance of your position. To read more about the risks, we highly recommend reading this post. We suggest using APY.Vision to keep a close eye on your positions to know when to remove liquidity during times of extreme price volatility.

APY.Vision does not give investment advice and always insists that you do your own research. Read our full Legal Disclaimer.

Check out APY.Vision!

APY.Vision is an advanced analytics tool for liquidity pool providers and yield farmers. If you’re using any DEXs, AMMs, or liquidity pools this is the tool you will need to easily track the ROI of your liquidity provider and yield farming activities. Try it now!