How to provide liquidity to Beefy Finance Vaults on Polygon

In this guide we will explain how to provide liquidity to Beefy vaults on the Polygon network to earn swap fees and yield farming rewards that are auto-compounded.

What is Polygon?

Polygon is a scaling solution for Ethereum with fast and cheap transactions. It is a seperate blockchain with different features and parameters which requires moving funds across a “bridge” to get on the Polygon network. The Polygon network uses different technologies than Ethereum Layer 1 so it has a different security model and is able to have lower transaction costs.

What is Beefy Finance?

Beefy Finance is a Decentralized, Multi-Chain Yield Optimizer platform that allows its users to earn compound interest on their crypto holdings. Through a set of investment strategies secured and enforced by smart contracts, Beefy Finance automatically maximizes the user rewards from various liquidity pools (LPs), automated market making (AMM) projects, and other yield farming opportunities in the DeFi ecosystem.

The main product offered by Beefy Finance are the ‘Vaults’ in which you stake your crypto tokens. The investment strategy tied to the specific vault will automatically increase your deposited token amount by compounding arbitrary yield farm reward tokens back into your initially deposited asset. Funds are never locked in any vault on Beefy Finance: you can always withdraw at any moment in time.

What you will need to provide liquidity on Beefy

- Metamask wallet

- MATIC tokens in your Polygon wallet for gas

- LP Tokens to deposit into the vaults (or tokens you can use to swap into the tokens needed for a given vault

Setting up the Polygon network with your Metamask wallet

First, you will need to configure your Metamask wallet to connect to the MATIC network. You will need to open Metamask and click on the Network selection dropdown and then click on Custom RPC.

Fill out the empty fields as shown in the picture above and click on Save. You will be directly switched to Matic’s Mainnet now in the network dropdown list. This process adds the MATIC network to the list of available networks you can switch to from within Metamask. Sometimes it is helpful to switch networks when Metamask is acting strange or if you are having trouble getting things to show up.

Here is the list of the parameters so you can easily copy them:

- Network Name: Polygon Mainnet

- New RPC URL: https://polygon-rpc.com/

- Chain ID: 137

- Currency symbol: MATIC

- Block explorer URL: https://polygonscan.com/

Move funds from ETH network to Polygon/Matic network

The Polygon Wallet interface has a section labeled “Bridge” and it will bring you to the interface pictured above. Once you have moved funds over to the Polygon networks you can manage them from the same Polygon Web Wallet interface .

Finding the right Vault to provide liquidity to on Beefy

Beefy has a variety of options on their platform ranging from vaults that require LP tokens from an AMM to deposit to single asset vaults that only require depositing one type of token. You can use the filters at the top of the page to narrow your selection by a few different criteria like which AMM platform the LP tokens are from or which types of assets you are looking to stake. You can also sort by vault APY or TVL to get a sense of what is popular or performing well currently.

Platforms: Aave, ApeSwap, Beefy, Cometh, Curve, DinoSwap, IronFinance, JetSwap, Kyber, Mai, QuickSwap, SushiSwap

Vault types: Single Asset, Stable LP’s, Stables

Steps to add liquidity to Beefy vaults

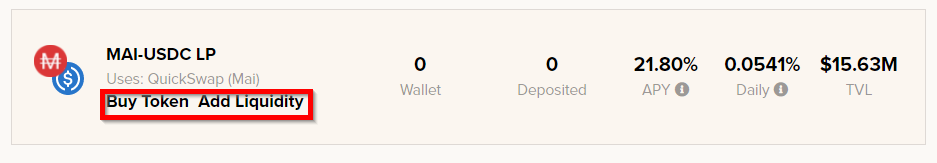

Step 1: Identify which vault you would like to deposit to and make sure you have either the single token or LP tokens needed to deposit. For more info on how to add liquidity to AMM’s to get the LP tokens, you can check out this article that offers a guide on supplying liquidity to QuickSwap. For this example we have chosen the MAI-USDC LP vault.

If you do not have the LP token, you can use the “Buy Token” link highlighted above to swap into the tokens needed for this vault. Once you have the 50/50 proportion of both tokens you can then use the “Add Liquidity” link to deposit the tokens into the AMM (Quickswap in this example) liquidity pool to get the LP tokens needed. The process for adding liquidity can vary from protocol to protocol, check our blog archives for guides on how to use many of them.

Step 2: For this vault, you will first need to go to QuickSwap and add liquidity to the MAI-USDC pair to get the LP tokens you need for this vault. You do NOT need to stake those LP tokens on QuickSwap as Beefy will be doing that for you.

Step 3: Click the “Approve” button and confirm the transaction then you will get an option to “Deposit” as pictured below. I usually use the “Deposit All” button to make sure there is no dust left in the wallet after. Hit either button and you will start auto-compounding! You will notice each vault comes with a set of fees, this particular vault charges 0.5% to deposit so be sure to factor that into your decision.

Once the deposit goes through you will see the balance reflected on the “Withdraw” side of the UI.

Tracking Your Position on APY.vision

Once your vault position is deposited on auto-compounding on Beefy, you can head over to APY.vision and enter your wallet address and start tracking the performance of the vault. APY.vision will separate the liquidity pool (MAI-USDC) activity from the vault activity (the auto compounding).

How to withdraw and what to expect

One important thing to note is that different vaults have different fees associated with deposits and withdrawals. The vault we are using has no withdrawal fees, but there are some that do.

When you are ready to pull your liquidity from the vault, simply hit one of the “withdraw” or “withdraw all” buttons and your LP tokens will be back in your wallet. To exit the liquidity pool entirely, you will have to go back to the AMM where you entered into the pool to get your tokens back. Note you only need to do this if you are in a vault using LP tokens, a single asset vault will not require these extra steps.

Conclusion

Providing liquidity is a great way to earn some income on tokens sitting in your wallet. You do have to be careful when providing liquidity, as sharp price increases or decreases can have a huge impact on the performance of your position. To read more about the risks, we highly recommend reading this post. We suggest using APY.Vision to keep a close eye on your positions to know when to remove liquidity during times of extreme price volatility.

APY.Vision does not give investment advice and always insists that you do your own research. Read our full Legal Disclaimer.

Check out APY.Vision!

APY.Vision is an advanced analytics tool for liquidity pool providers and yield farmers. If you’re using any DEXs, AMMs, or liquidity pools this is the tool you will need to easily track the ROI of your liquidity provider and yield farming activities. Try it now!