How to provide liquidity to Ubeswap on Celo

In this guide we will explain how to provide liquidity to Ubeswap pools on the Celo network to earn swap fees and token rewards.

What is Celo?

Celo is a mobile-first platform that makes financial dApps and crypto payments accessible to anyone with a mobile phone. The Celo network allows you to use crypto like everyday money on a platform designed for real-world use.

What is Ubeswap?

Ubeswap is a decentralized exchange and automated market maker protocol for Celo assets. Ubeswap enables Celo users and applications to trade between any two ERC20 tokens with a mobile-first interface. Ubeswap’s protocol design is based on Uniswap’s core contracts which means any DeFi application built using Uniswap can easily integrate with Ubeswap

What you will need to provide liquidity to Ubeswap on Celo

- Metamask wallet

- CELO tokens in your wallet for gas

- Two ERC-20 tokens to provide as liquidity on Ubeswap

Setting up the Celo network with your Metamask wallet

First, you will need to configure your Metamask wallet to connect to the Celo network. You will need to open Metamask and click on the Network selection dropdown and then click on Custom RPC.

Here is the list of the network parameters so you can easily copy them:

- Network Name: Celo (Mainnet)

- New RPC URL https://forno.celo.org

- Chain ID: 42220

- Symbol: CELO

- Block Explorer URL: https://explorer.celo.org

Fill out the empty fields as shown above and click on Save. You will be directly switched to Celo’s Mainnet now in the network dropdown list. This process adds the Celo network to the list of available networks you can switch to from within Metamask. Sometimes it is helpful to switch networks when Metamask is acting strange or if you are having trouble getting things to show up.

Move funds to Celo network

You can use the Mobius bridge to move tokens over to the Celo network from Ethereum, Polygon or Solana. You will need to connect your wallet to the network you are transferring your tokens from and then use the bridge to move them over to the Celo network. One thing to note is that the Celo network uses CELO as gas, so make sure you have bridged or sent some CELO tokens to your wallet to make transactions.

It is important to note that certain stablecoins and assets have different token tickers based on where they were bridged from. If you need to convert from one to the other, you can use the “Swap” feature on Mobius to do so.

Finding the right pool to provide liquidity

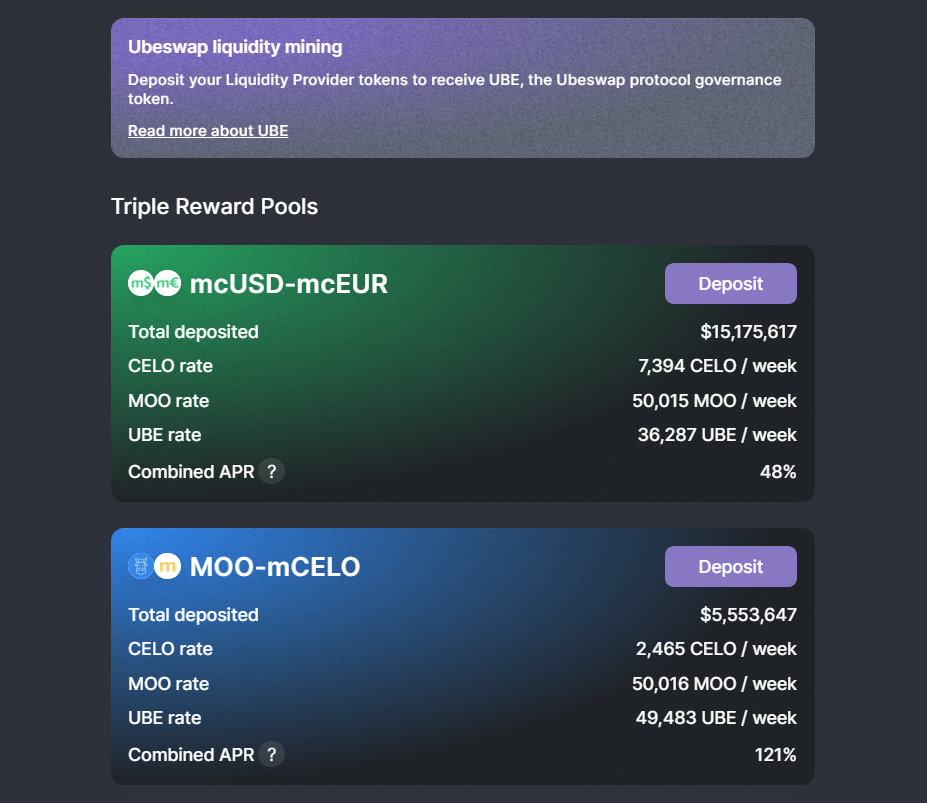

To find the best rewards on Ubeswap click “Farm” at the top of the page to get to the Farming rewards Menu. Ubeswap has Triple Reward farms (CELO, MOO, and UBE), Double Reward farms, and standard UBE farms. You will need to click the “Add Liquidity” to get to the interface for adding liquidity.

You can also use APY.vision’s pool search feature to discover new pools on Ubeswap. Check it out here.

Steps to add liquidity to Ubeswap

Using this menu you can select a token pair that you would like to provide liquidity to. Remember, you have to put an even proportion of each token into the pool (50/50) and you will typically have to approve each token before you can add liquidity.

Once you have added the liquidity, you will have Ubeswap Liquidity tokens in your wallet that you can manage from the Ubeswap site and then proceed to stake those tokens to start earning rewards.

Ubeswap will give a readout of the token balances that indicate your share of the pool based on how many tokens you entered into the pool as shown below.

Stake your LP tokens to start earning rewards

Once you have the UBE LP tokens, you can then stake them to earn your rewards by hitting the “Approve” button, and then once it is approved the button will turn into a “Stake” button. Once it is staked, you will start earning your UBE rewards!

How to withdraw liquidity and what to expect

Much like with Uniswap, when you withdraw your liquidity from the Ubeswap pools you will get back a different number of each token than when you started. That is due to the automatic rebalancing that is a core feature of automated market makers (AMM’s).

You are able to see this process in action when tracking your tokens on APY.Vision. APY.Vision provides real-time tracking that illustrates the impermanent loss or gain of a liquidity pool position as shown below.

To withdraw your liquidity from Ubeswap, you must first unstake the UBE LP tokens if you had them staked and earning rewards. Once they are unstaked you can hit the “Remove Liquidity” and your UBE LP tokens will be converted back into the two tokens you initially entered into the pool.

Conclusion

Providing liquidity is a great way to earn some income on tokens sitting in your wallet. You do have to be careful when providing liquidity, as sharp price increases or decreases can have a huge impact on the performance of your position. We suggest using APY.Vision to keep a close eye on your positions to know when to remove liquidity during times of extreme price volatility.

APY.Vision does not give investment advice and always insists that you do your own research. Read our full Legal Disclaimer.

Check out APY.Vision!

APY.Vision is an advanced analytics tool for liquidity pool providers and yield farmers. If you’re using any DEXs, AMMs, or liquidity pools this is the tool you will need to easily track the ROI of your liquidity provider and yield farming activities. Try it now!