How to provide liquidity to SushiSwap on Arbitrum

In this guide we will explain how to provide liquidity to Sushiswap pools on the Arbitrum network to earn swap fees and SUSHI rewards.

What is Arbitrum?

Arbitrum is a suite of Ethereum scaling solutions created by Offchain Labs that enables high-throughput, low cost smart contracts while remaining trustlessly secure. Arbitrum has three modes: AnyTrust Channels, AnyTrust Sidechains, and Arbitrum Rollup.

What is Sushiswap?

SushiSwap is a fork of Uniswap with the SUSHI token as a focal piece. It grants control over the protocol to holders and pays a portion of fees to them and strives to be a community oriented project that rewards its users.

What you will need to provide liquidity on Arbitrum Sushiswap

- Metamask wallet

- ETH tokens in your wallet for gas

- Two ERC-20 tokens to provide as liquidity on Sushiswap

Setting up the Arbitrum network with your Metamask wallet

First, you will need to configure your Metamask wallet to connect to the Arbitrum network. You will need to open Metamask and click on the Network selection dropdown and then click on Custom RPC.

Here is the list of the network parameters so you can easily copy them:

- Network Name: Arbitrum One

- New RPC URL: https://arb1.arbitrum.io/rpc

- Chain ID: 42161

- Symbol: AETH

- Block Explorer URL: https://arbiscan.io/

Fill out the empty fields as shown above and click on Save. You will be directly switched to Arbitrum’s Mainnet now in the network dropdown list. This process adds the Arbitrum network to the list of available networks you can switch to from within Metamask. Sometimes it is helpful to switch networks when Metamask is acting strange or if you are having trouble getting things to show up.

Move funds to Arbitrum network

You can use the “Arbitrum One Bridge” to move tokens over to the Arbitrum network from Ethereum. You will need to connect your wallet to the network you are transferring your tokens from and then use the bridge to move them over to the Arbitrum network. Just like Ethereum mainnet, Arbitrum uses ETH as gas so make sure you bridge some over. You can use L2fees.info to get sense of what the current gas costs are on Arbitrum.

Finding the right pool to provide liquidity

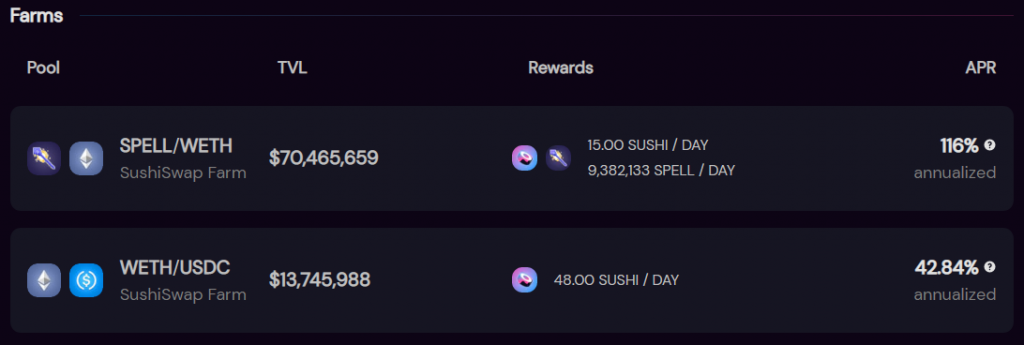

To find the best rewards on Sushiswap click “Farm” at the top of the page to get to the Farming Menu. Once you click on a farm you would like to deposit into, you will need to click the “Add Liquidity” toggle switch to get to the interface for adding liquidity.

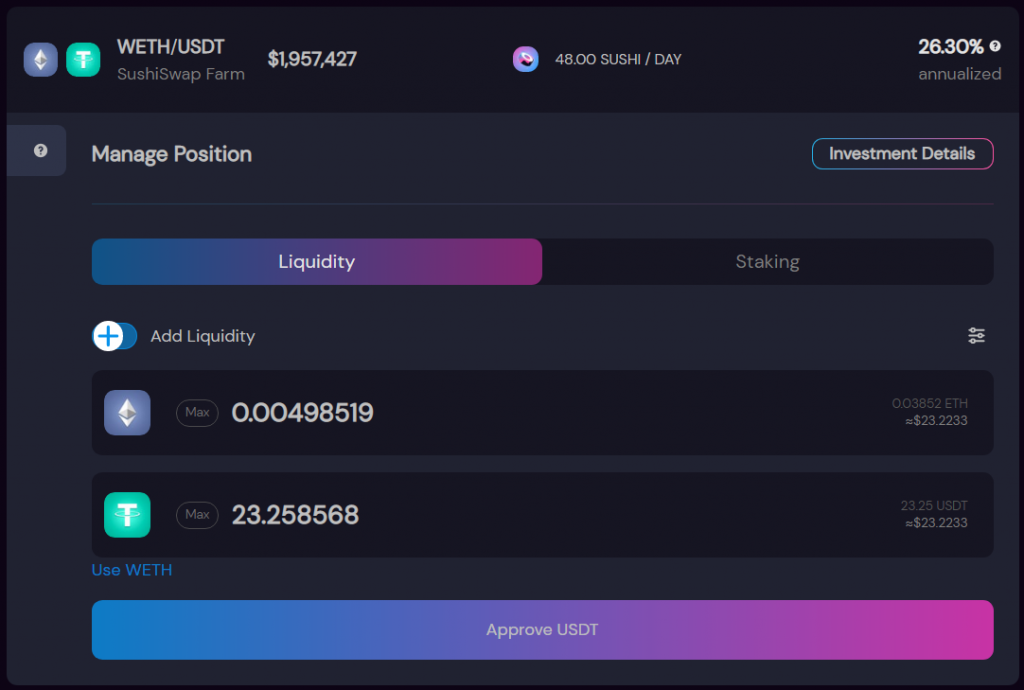

Steps to add liquidity to Sushiswap

Using this menu you can select a token pair that you would like to provide liquidity to. Remember, you have to put an even proportion of each token into the pool (50/50) and you will typically have to approve each token before you can add liquidity. Luckily on the Arbitrum network this does not cost very much in gas.

Once you have added the liquidity, you will have Sushiswap Liquidity tokens (SLP) in your wallet that you can manage from the Sushiswap site and then proceed to stake those SLP tokens to start earning rewards.

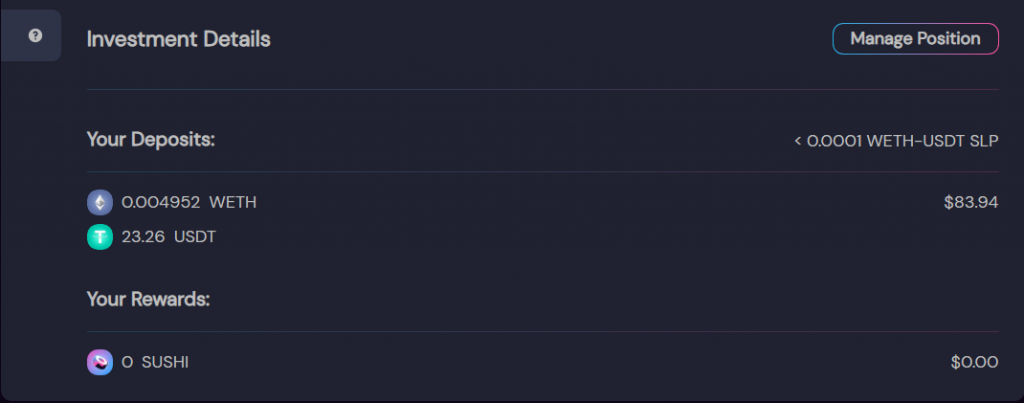

After you have added liquidity, Sushiswap will give a readout of the token balances that indicate your share of the pool based on how many tokens you entered into the pool as shown below.

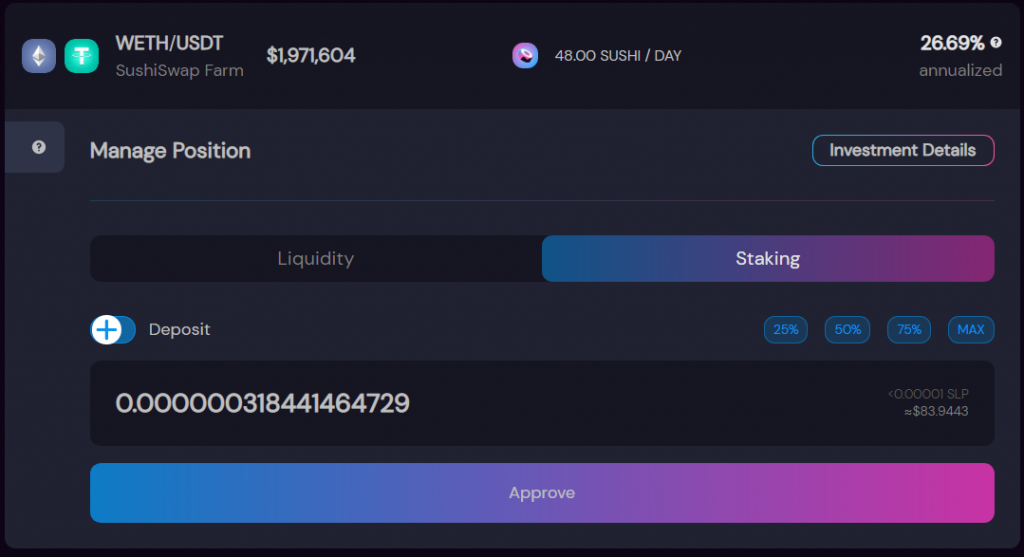

Stake your SLP tokens to start earning SUSHI rewards

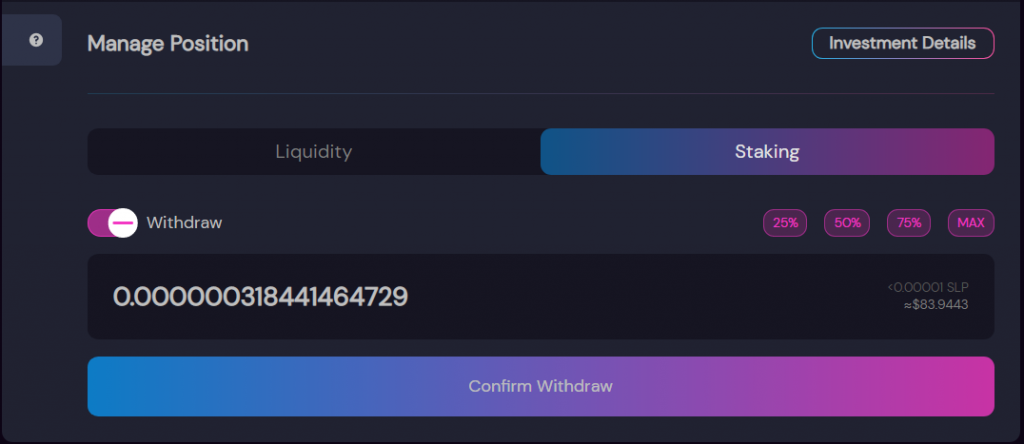

Once you have the SLP tokens, you can then stake them to earn your SUSHI rewards by hitting the “Approve” button and then once it is approved the button will turn into a “Stake” button. Once it is staked, you will start earning your SUSHI and ONE rewards!

How to withdraw liquidity and what to expect

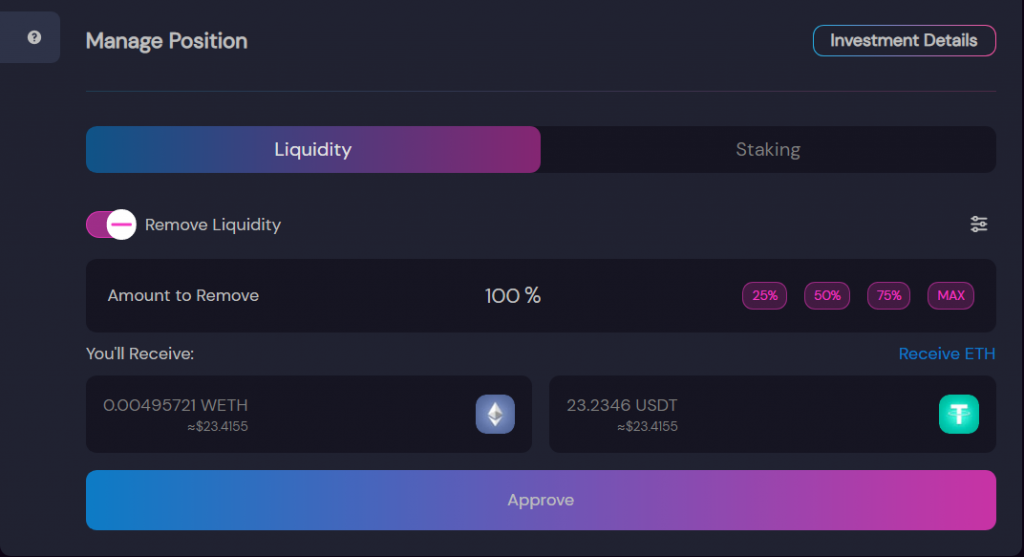

In the above picture you will see a toggle switch that has to be moved to the (-) positions to open the withdraw interface. Much like with Uniswap, when you withdraw your liquidity from the Sushiswap Arbitrum pools you will get back a different number of each token than when you started. That is due to the automatic rebalancing that is a core feature of automated market makers (AMM’s).

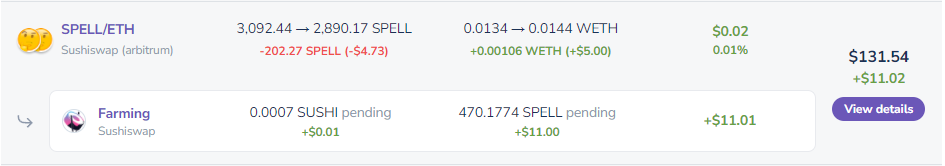

You are able to see this process in action when tracking your tokens on APY.Vision. APY.Vision provides real-time tracking that illustrates the impermanent loss or gain of a liquidity pool position as shown below.

To withdraw your liquidity from Sushiswap, you must first unstake the SLP tokens if you have them staked and earning rewards. Once they are unstaked you can go back to the “Liquidity” tab flip the toggle switch to “Remove Liquidity” and your SLP tokens will be converted back into the two tokens you initially entered into the pool.

Conclusion

Providing liquidity is a great way to earn some income on tokens sitting in your wallet. You do have to be careful when providing liquidity, as sharp price increases or decreases can have a huge impact on the performance of your position. We suggest using APY.Vision to keep a close eye on your positions to know when to remove liquidity during times of extreme price volatility.

APY.Vision does not give investment advice and always insists that you do your own research. Read our full Legal Disclaimer.

Check out APY.Vision!

APY.Vision is an advanced analytics tool for liquidity pool providers and yield farmers. If you’re using any DEXs, AMMs, or liquidity pools this is the tool you will need to easily track the ROI of your liquidity provider and yield farming activities. Try it now!