How to provide liquidity to Katana on Ronin

In this guide we will explain how to provide liquidity to Katana pools on the Ronin network to earn swap fees and yield farming rewards. You will be able to track that position on APY.vision.

What is Ronin?

Ronin is an Ethereum-linked sidechain made specifically for Axie Infinity. To help secure Ronin, Sky Mavis has recruited partners from the traditional gaming, crypto, and nonfungible token space to serve as validators of the network. Sky Mavis (the developers of Axie) created the Ronin Blockchain in order to enable gas-free axie breeding and the gas-free transfer of SLP, AXS, and Axies between Ronin wallets

What is Katana?

Katana is a decentralized exchange for the Ronin sidechain It allows anyone to easily swap between the various assets within the Axie Infinity ecosystem at a low cost.

What you will need to provide liquidity on Katana on Ronin

- Ronin wallet

- Transactions are temporarily free with registration

- Two tokens (in equal amounts) to provide as liquidity on Katana. Current supported tokens are ETH, AXS, SLP, USDC

Setting up the Ronin wallet

In order to use the Ronin chain you must use the Ronin wallet, which has a mobile app and a browser extension. The setup is very similar to Metamask, you will be given a seed phrase which is important to save in a secure place. On the mobile application you will be asked to set a 6 digit pin for access, while on the browser extension you will be asked to create a password. Ronin also has a block explorer that allows you to view your transactions and get more details.

Register your email and username to get 100 free transactions per day

To get free transactions you have to login to the Axie marketplace with your wallet and create a username and password and give them an email for verification. There can be a 15 to 20 minute waiting time for the registration to get recognized for the free transactions.

The interface for the Ronin wallet is similar to many other wallets, in the picture above the red square indicates the button to copy your wallet address.

Move funds from ETH network to the Ronin chain

Key takeaway: The only options for bridging at the moment are from the Ethereum network to the Ronin network and back.

The Ronin bridge allows you to transfer supported assets from the Ethereum network to the Ronin network, and allows you to withdraw from the Ronin network back to the Ethereum network. The list of supported assets is as follows ETH, AXS, SLP, USDC and AEC. Axie.live will give you a preview what the gas prices are to bridge assets from Ethereum.

Finding the right pool to provide liquidity on Katana

There are only a few supported assets on Katana at this time so there are a limited number of liquidity pools to farm. You can view these pools by clicking the “Farm” tab on the Katana application. As of the time of writing, the two pairs that you can earn RON rewards on are AXS/WETH and SLP/WETH.

Steps to add liquidity to Katana

In order to invest in one of the pools featured you will need to have the tokens in the pair in equal amounts. You can do that by using the “Swap” feature on Katnan to swap into two of the farmable assets. One you have the assets you can navigate to the “Pool” section where you will see the option to add liquidity as pictured above.

If it is your first time interacting with the pool you will have to make an “approve” transaction and then you will get the option shown above. If you use the “Max” button it will deposit 100% of that token and automatically match the other token to that amount to ensure the 50/50 ratio.

One you hit “Supply” you will see the information about what you will receive once confirming the supply. Hit the button pictured above and you will need to sign a transaction. Once the transaction is complete you will have the LP tokens needed for staking and farming.

Stake your LP tokens to start earning rewards

Once you have the LP tokens in your wallet from providing liquidity, you can then navigate to the “Farm” section of the Katana app to stake your LP tokens and start earning RON rewards.

After hitting the “Stake” button another box will come up asking how many LP tokens you want to stake. Input the amount or hit the “Max” button to automatically deposit them all and you will start earning RON!

Click on the farm you have deposited your LP tokens into to find out how much RON you have earned for providing liquidity to the pool.

Track Your Position on APY.vision

Visit the APY.vision Ronin page!

First time APY.vision users – enter your Ronin address in the box highlighted above. On mobile/tablets click on the search icon and copy their address into the popup

Pro APY.Vision users – add your Ronin wallet by clicking the box showing your wallet address and selecting “Add a wallet address” and pasting in your Ronin wallet address.

Free APY.vision users – If you already have a wallet connected to APY.vision and do not have the Pro plan, you will need to disconnect your current wallet before you will be able to enter your Ronin wallet for tracking.

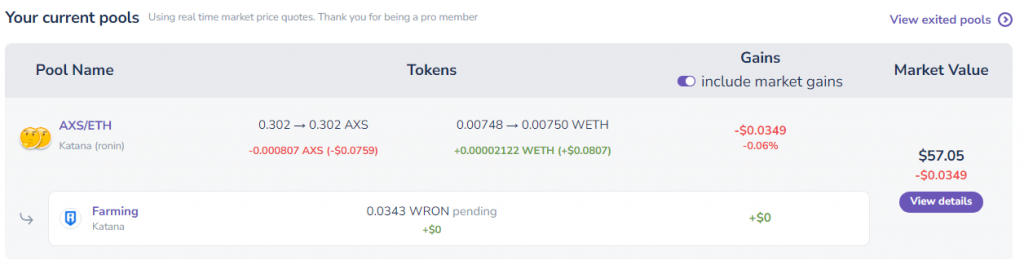

Once you have connected your wallet you will be able to see your gains or losses in token balance, your fees collected and impermanent loss information, and the ability to track your farming rewards!

How to withdraw liquidity and what to expect

When you are ready to pull your liquidity from the farm, you must first hit the “Unstake” button and the dialog box below will pop up to unstake it. This action will harvest your RON rewards at the same time it unstakes the LP token from the staking contract.

After you have unstaked your LP tokens, navigate over to the “Pool” section of the app and you will be given a view of your liquidity positions as pictured above. Click the Remove option and a dialog box will appear to confirm your selection as pictured below. Once you have removed liquidity your wallet will be sent the tokens in the amount pictured.

After this process is complete you will have the two tokens from the pool back in your wallet.

Conclusion

Providing liquidity is a great way to earn some income on tokens sitting in your wallet. You do have to be careful when providing liquidity, as sharp price increases or decreases can have a huge impact on the performance of your position. To read more about the risks, we highly recommend reading this post. We suggest using APY.Vision to keep a close eye on your positions to know when to remove liquidity during times of extreme price volatility.

APY.Vision does not give investment advice and always insists that you do your own research. Read our full Legal Disclaimer.

Check out APY.Vision!

APY.Vision is an advanced analytics tool for liquidity pool providers and yield farmers. If you’re using any DEXs, AMMs, or liquidity pools this is the tool you will need to easily track the ROI of your liquidity provider and yield farming activities. Try it now!