How to provide liquidity to Curve on Avalanche

In this guide we will explain how to provide liquidity to Curve pools on the Avalanche network to earn swap fees and CRV token rewards.

What is Curve?

Curve is a decentralized exchange designed for extremely efficient stablecoin trading and low risk, supplemental fee income for liquidity providers via the CRV token rewards. Curve allows users to trade between stablecoins with a low slippage, low fee algorithm designed specifically for stablecoins and earn fees. What makes Curve different from other DEX’s?

Curve uses similar principles to other AMM’s like Uniswap with the use of bonding curves and liquidity pools. Curve engineering their system to be highly efficient for the swapping of assets that are stable, i.e. stablecoins like DAI, USDC, USDT and others. This is accomplished by using a different shape curve than the model used by Uniswap and keeps slippage and fees low.

What is Avalanche?

Avalanche is an open-source platform for launching decentralized applications and enterprise blockchain deployments in one interoperable, highly scalable ecosystem. Avalanche is a decentralized smart contracts platform built for the scale of global finance, with near-instant transaction finality.

A key difference between Avalanche and other decentralized networks is the consensus protocol. The Avalanche protocol employs a novel approach to consensus to achieve its strong safety guarantees, quick finality, and high-throughput without compromising decentralization.

What you will need to provide liquidity on Curve on Avalanche

- Metamask wallet

- AVAX tokens in your Avalanche wallet for gas

- Supported tokens to provide as liquidity on Solidly

Setting up the Avalanche network with your Metamask wallet

Much like with other EVM compatible networks, you can use Metamask to interact with Avalanche. Avalanche has a web wallet you can use to check balances. To configure your MetaMask to have the ability to access the Avalanche network you need to click the icon in the top right corner and select “Settings”. Once there, find the tab labeled “Networks” and when you arrive there you should see a button to “Add Network” where you can input the settings below:

Here is the list of the parameters so you can easily copy them:

- Network Name: Avalanche Network

- New RPC URL: https://api.avax.network/ext/bc/C/rpc

- ChainID: 43114

- Symbol: AVAX

- Explorer: https://snowtrace.io/

This process adds the Avalanche network to the list of available networks you can switch to from within Metamask. Sometimes it is helpful to switch networks when Metamask is acting strange or if you are having trouble getting things to show up.

RESOURCE: Use Chainlist.wtf to get details for any chains supported by Metamask!

How to move funds to the Avalanche chain

- APY.vision has a new Bridge tool that can help you find paths between many different chains

You can also use the bridge that was built by the Avalanche team.

Where does the yield come from?

For every trade on Curve.fi, liquidity providers earn fees from the swap, this is why the listed APRs will fluctuate a lot based on volume and volatility. It’s important to note that because fees are dependent on volume, daily APRs can often vary wildly depending on market conditions. In addition to the yield from trading, Curve also issues the CRV token as a reward to liquidity providers.

Finding the right pool to provide liquidity on Curve

Curve has different incentivized pools depending on which chain you are using. The tokens eligible for deposit are listed below the pool (example: 3pool can take deposits of UST, USDC or USDt). The APY’s listed have various components to them.

- The “Base vAPY” is a figure that changes daily depending on the trading activity in the pool.

- The “Rewards tAPR” is a number that has a range that tells you the CRV rewards you can earn from being in the pool.

Curve also has a system (veCRV) for locking CRV tokens which can boost your APY, the low end of the range is for no locking and the high end of the range is based on locked CRV.

Volatile asset pools

One of the latest additions to Curve is a move away from their traditional model of stablecoin pools. In the “tricrypto” crypto pool, depositors have exposure to wrapped Bitcoin and Ethereum as well as fUSDT. While these pools typically have higher rewards, they also expose you to impermanent loss due to price fluctuations in BTC and ETH.

Steps to add liquidity to Curve

After finding the pool you would like to enter and clicking on it, navigate to the “deposit” section using the top of the page to bring up the screen above. For this example, we will be depositing into the “USDC.E – UST” pool. You will need one of those tokens to deposit into the pool, but unlike Uniswap you do not need to have a proportional amount of another token. You will need to enter the amount of tokens you plan to deposit as highlighted above.

Curve will give you a “deposit bonus” if the token you are supplying is under supplied to the pool as shown in the “Currency Reserves” section.

Example:

USDC.e: 125,799.80 (10.51%)

UST: 1,071,547.35 (89.49%)

USDC.e+UST: 1,197,347.15

You can see that USDC has a lower ratio than UST, so Curve will issue a deposit bonus for helping to even out the ratio by depositing USDC. This also works when withdrawing from the pool, if you withdraw the token with a higher ratio you will get a small bonus.

You can see in the above image there are two options presented: “Deposit” and “Deposit & stake in gauge”. Clicking “Deposit” will put your tokens into the pool and start earning the “Base vAPY”. In order to get the CRV rewards, you must also “stake in gauge” and the interface allows you to do that by clicking the button, although there are two transactions that take place. The first transaction is the deposit, and the second transaction is to stake the LP token for rewards.

After clicking “Deposit” you can see that the funds still need to be staked in order to earn CRV rewards as shown below. We will need to sign one more transaction to stake and start earning rewards.

After you complete the staking transaction, you should see the reported balances move from “My share” to “Staked share” as highlighted below.

How to track your Curve portfolio with APY.Vision

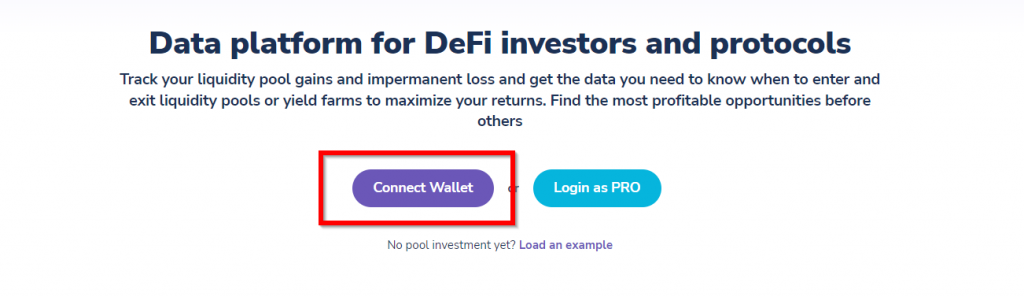

First time APY.vision users – Connect your Avalanche wallet with the box highlighted above. On mobile/tablets click on the search icon and copy their address into the popup

Curve pools are tracked on APY.Vision so depositors can keep track of their impermanent loss and track their profits from being in the pools. APY.Vision will display the shift in token balances in the pool based on market activity as well as the CRV farming rewards.

How to withdraw and what to expect

When you are ready to exit the Curve pool, navigate to the “Withdraw” section of the page.

You will be presented with 3 options, Withdraw, Withdraw & claim and Unstake from gauge. Withdraw removes your funds from the 2pool and will be deposited in your wallet in USDC or UST depending on which token you select to withdraw into. Withdraw & claim does the same as Withdraw with the added function of claiming any CRV rewards as well. The unstake from gauge option keeps the funds in the 2pool but removes them from staking and earning the CRV rewards. The red arrow is highlighting the slippage warning for withdrawing into the token that doesn’t benefit the pool. Selecting USDC instead of UST would show a bonus rather than a slippage warning.

Once you withdraw from the 2pool you are ready to use those stablecoins somewhere else!

Conclusion

Providing liquidity on Curve is a popular way for crypto investors to earn a healthy yield on their stablecoin holdings without taking on risk of impermanent loss as is the case with other types of liquidity pools. The returns may not be as attractive as some of the rewards you see on more volatile pools, but risk averse investors find Curve to be an attractive home for their stablecoins.

Join our Community!

If you have any questions about the new features on APY.vision, feel free to come join our Discord community and share them! Our community is super helpful and we always like to hear input from our users. If you experience and bugs or notice problems with the website, you can create a ticket via our support system. If there are features you would like to see added to the website, you can make suggestions or vote on previous suggestions here!

APY.Vision does not give investment advice and always insists that you do your own research. Read our full Legal Disclaimer.

Check out APY.Vision!

APY.Vision is an advanced analytics tool for liquidity pool providers and yield farmers. If you’re using any DEXs, AMMs, or liquidity pools this is the tool you will need to easily track the ROI of your liquidity provider and yield farming activities. Try it now!